“In psychology, cognitive dissonance is the mental stress (discomfort) experienced by a person who simultaneously holds two or more contradictory beliefs, ideas, or values, when performing an action that contradicts those beliefs, ideas, and values; or when confronted with new information that contradicts existing beliefs, ideas, and values.” – Cognitive dissonance, Wikipedia

It is now February 2017. Everything continues in slow motion in US stocks, with the other global equity markets playing the same tune. It is though nothing could send stocks into a bear market again….at least that is the impression the markets are giving the public emotionally.

In other words, why worry or think? If we look at “negative” financial information, it can create stress.

Yet, headlines like these make us uncomfortable with our “never decline” stock market images as other financial bubbles are cracking around the globe. One every American with money in the Dow 20,000 bubble should consider is the China property bubble.

China Makes Curbing Property Bubble A Priority in 2017, Nikkei Asian Review, Dec 17, 2016

China Tightens Monetary Policy Via Repo- Rates Rise, MarketWatch, Feb 3 ‘17

A couple of years ago I walked through a big home supply store where I live, seeking to see where items were made. I went down aisle after aisle. By far the largest country making products for this store was China. I looked at products in others stores and found similar results.

So when the Communist government in China seeks to deflate their property bubble followed a few weeks later by actions tightening credit and raising interest rates, I pay close attention.

The reason is simple. The two nations depend on each greatly.

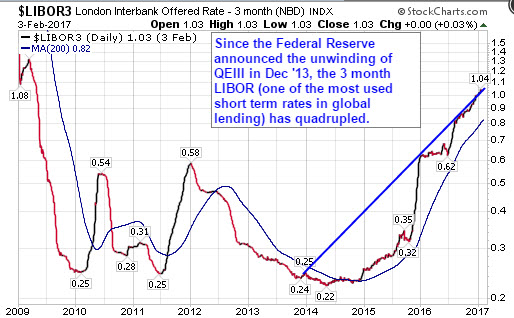

If you create trillions in new debt across the nations of the world to levitate asset prices and stimulate your economy, eventually lending rates rise and those projects that came from that torrent of debt must be sustainable on its own. Otherwise prices must adjust downward as credit tightens, bad loans rise, and spending slows.

But this outlook is not happy. In fact, it’s sobering. We had rather seek information that fits the narrative we want to believe.

As long as the “felt wealthy” game continues, we come to trust in the “wealth effect”. And why shouldn’t we? These words were spoken by Chairman Bernanke in the fall of 2012.

Fed Seeking to Create Wealth, Not Just Cut Rates, Yahoo News, Sept 14 ‘12

The idea is for the Fed’s $40 billion-a-month in bond purchases to lower interest rates and cause stock and home prices to rise, creating a “wealth effect” that would boost the economy.

And “if people feel that their financial situation is better because their 401(k) looks better or for whatever reason — their house is worth more — they’re more willing to go out and spend,” Chairman Ben Bernanke told reporters. “That’s going to provide the demand that firms need in order to be willing to hire and to invest.”

If you went out and borrowed money to buy a house, car, new clothes, and take a vacation, would you FEEL successful? Could you LOOK successful to others around you, many even doing the same? So what is the problem with such actions, especially if the state (i.e. Federal Reserve) creates trillions in debt out of thin air to alter our perceptions?

Easy. You are front running the economy with trillions in cheap debt that at some point, must be paid back, rolled into a new loan pushing out the debt further, or default.

A year ago, Richard Fisher, former President of the Federal Reserve Bank of Dallas, told the public the “wealth effect” was not a sustainable plan.

“What the Fed did, and I was part of it, was front-loaded an enormous market rally in order to create a wealth effect.” [‘We Front-Loaded an Enormous Stock Market Rally’, Seeking Alpha, Jan 7 ‘16]

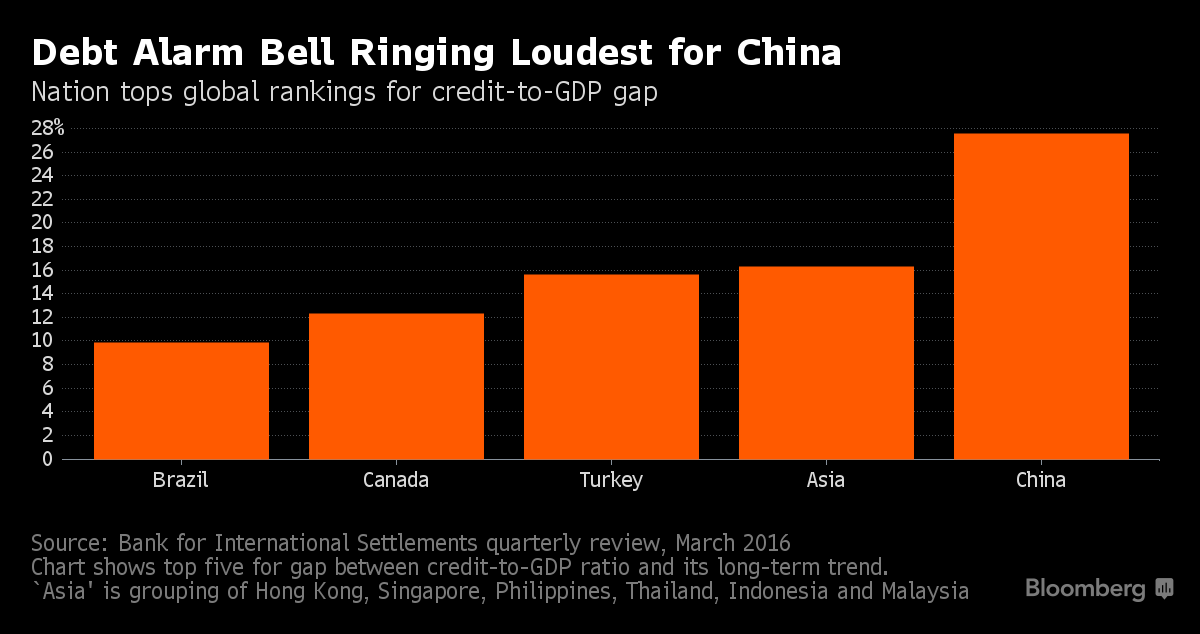

But this story is not solely from the actions of the Federal Reserve; this story, fostered by the People’s Bank of China, created the largest expansion of debt of any nation in world history.

China’s total debt stock more than tripled between 2000 and 2007 and quadrupled from 2007 to 2014. This was a $26 trillion increase. As debt flooded the nation in projects that  were totally unsustainable from the start, the drag from this debt and rising delinquent loans continues to slow their economy. When we consider that roughly a third of global debt growth between 2007 and 2014 came from China’s historic debt explosion, what happens in China will impact the rest of the world? For the United States and China to be so closely dependent on each other, the a collapse of their property bubble will impact Americans.

were totally unsustainable from the start, the drag from this debt and rising delinquent loans continues to slow their economy. When we consider that roughly a third of global debt growth between 2007 and 2014 came from China’s historic debt explosion, what happens in China will impact the rest of the world? For the United States and China to be so closely dependent on each other, the a collapse of their property bubble will impact Americans.

To have China front run their economy with massive sums of debt, while the Federal Reserve did the same through QE policies since 2009, severe consequences must come.

The Unreal, Eerie Emptiness of China’s ‘Ghost Cities’, Wired, Feb 4 ‘16

“Cities and districts built without demand or necessity resulted in what some Chinese scholars have termed, literally, ‘walls without markets’,” says William Hurst, political science professor at Northwestern University. …“Political exigency and investment hysteria trumped economic calculus or consideration of genuine human needs.”

Top China Credit Analyst Says Bad Debt Ratio May Hit 22%, Loan Losses in Trillions, Bloomberg/Contra Corner, May 25 ‘16

Tighter credit conditions are coming everywhere we look. The Dow 20,000 is a way to keep investors and Americans living in the “wealth effect” until the “debt effect” from such policy cracks our complacency.

For now, we continue watching the biggest stock bubble on record, placing our “faith” in more corruption of markets through constant actions by global central banks.

Shhh, don’t wake us. Facing another bust only creates cognitive dissonance.

A Curious Mind