“No one can serve two masters; for either he will hate the one and love the other, or else he will be loyal to the one and despise the other. You cannot serve God and mammon.” – Matthew 6:24 , NKJV

“No one can serve two masters; for either he will hate the one and love the other, or else he will be loyal to the one and despise the other. You cannot serve God and mammon.” – Matthew 6:24 , NKJV

To The World of 2024,

In 2010, I wrote a public article titled, John’s Economic Worldview. In the opening pages, I discussed what is known as one’s worldview. Every individual has one, whether they can describe it or not.

The following are four traits of one’s worldview, as presented by Belgium philosopher, Leo Apostel:

1. A futurology – “Where are we headed?”

2. Values and ethics – “What should we do?”

3. A methodology – “How shall we attain our goals?”

4. A theory of knowledge – “What is true and false?”

Since 2010, I have watched with frustration and yet fascination, at how much “faith” most Americans place in our money, a substance that all major nations have been creating through the expansion of their debt loads since the US removed the dollar from the gold exchange standard in 1971. Most individuals have little or no understanding of the history of money, or the fact that the more money is created, the larger the debt load and the greater the drag on the entire economy long term.

Thus, the question, “Where are we headed?”, is most often based on one’s personal experience, rather than a close examination of the history of money.

Since the historical data is the same for every person, and modern money is created by the expansion of debt, let’s take a quick look at the question “How shall we attain our goals?”, and how this has worked since WWII.

Getting Rich Quickly By Rapidly Going into Debt

When my father returned from WWII in 1945, the US national debt stood at $250 billion. It would continue to rise, reaching $394 billion in 1971. During this 26 year period, the United States would exchange its gold for any nation desiring to exchange their U.S. dollars for our gold.

However, as of August 1971, this option was closed to every nation worldwide, and the world’s major industrial powers were no longer willing to exchange their paper money for the gold they were holding. This had NEVER happened in history prior to 1971.

From that point on, it was paper debt based money for paper debt based money, controlled at the highest levels by the most powerful central banks in the world.

Between 1971 and 2000 – the top of the first stock/debt bubble – the US national debt grew by $5,206 billion (1,321%) to reach $5,600 billion.

Remember, under the gold exchange standard between 1945 and 1971 (26 years), the US national debt only grew by $144 billion or 57%. Once the gold exchange standard was removed, the US national debt exploded $5,206 billion (1,321%) in 29 years!

Now what individual or corporate leader would say that growing their debt by 51% is WORSE than growing it by 1,321%? Yet as a society all of this new debt had to go some place, and thus became the fuel to inflate prices everywhere.

For those who had wealth, the new debt became the most powerful source for growing that wealth. How could devaluing our money be bad? For those who did not have wealth, or whose lives were impacted by loss of capital and/or job, the rise in prices caused by this new debt which was devaluing their money moved them more and more down the economic food chain.

Record 93,175,000 Americans Not In the Labor Force, Breitbart, April 3 ’15

The answer to the question, “Where are we headed?” should have seemed obvious in 2000. It should be even more so in 2015, when the US national debt has more than tripled from 5.6 trillion in 2000 to 18.1 trillion today.

However, it wasn’t then, and isn’t today. While most individuals would never encourage an individual or company to rapidly grow their debts in order to become richer, our “faith” in unlimited national debt as the basis for unlimited money boggles the mind.

Once again, our main barometer seems to return to our own personal experience, versus the financial history of the entire nation.

Two Bubbles Popped; Waiting for Third One

As more and more debt can give an individual an image of wealth, without examining the growing debt levels, one is never looking at the entire picture. The same for a nation.

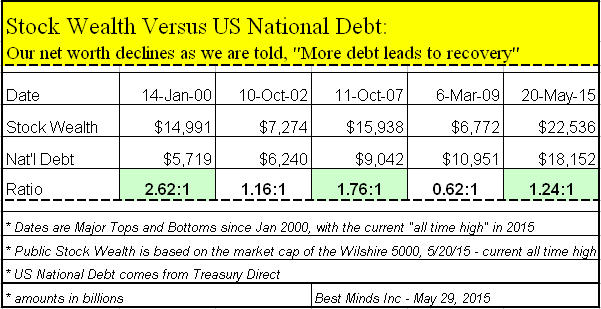

The chart above uses two metrics; the stock wealth, based on the value of the market capital of the Wilshire 5,000 at any given time – the broadest measure of publicly traded US stock wealth, and the national debt of the United States.

While an individual or group of individuals can say that they are wealthier today than in 2000, comparing the wealth/debt ratio based on these two variables, we find that the stock to debt ratios are substantially lower today than they were 15 years ago in 2000.

By asking the question, “ How do we attain our goals?”, we must differentiate between short term and long-term views. Twice since 2000, US stock bubbles have burst, completely wiping out wealth that took years to build. NEVER since 2000 has the amount of debt carried by the nation gone down. ALWAYS, the solution for a market decline was cut interest rates and print up more money (i.e. debt) to kick start the “recovery”. With 2015 being the seventh year of a zero interest rate policy by the Federal Reserve, cutting rates is out of the question for future slowdowns.

Andrew Carnegie and Jesus

In 2003, a friend suggested I read the book, The Call: Finding and Fulfilling The Central Purpose of Your Life (1998), by Os Guinness. Guinness challenges his readers through the lens of two lives in the chapter, More, More, Faster, Faster.

The first is Andrew Carnegie, one of the wealthiest men in American history.

Andrew Carnegie wrote this famous memorandum in 1868, when he was thirty-three and stuffed it away in a drawer: ‘Man must have an idol – the amassing of wealth is one of the worst species of idolatry – no idol is more debasing than the idol of money.’

But in 1905, President Theodore Roosevelt wrote reluctantly of Carnegie himself, ‘I tried hard to like Carnegie, but it was pretty difficult. There is no type of man for whom I feel a more contemptuous abhorrence than for one who makes a God of mere money- making.’

The second was a closer examination of the words Jesus presented in the Sermon on the Mount, specifically Matthew 6:24, as stated at the opening of this post:

“Jesus’ use of Mammon (Aramaic for wealth) is unique – he gave it a strength and precision that the word never had before. He did not usually personify things, let alone deify them. And neither the Jews nor the nearby pagans knew a god by this name. But what Jesus says in speaking of Mammon is that money is a power – and not in a vague sense, as in the “force” of words. Rather, money is a power in the sense that it is an active agent with decisive spiritual power and is never neutral. It is a power before we use it, not simply as we use it or whether we use it well or badly.

As such, Mammon is a genuine rival to God.”

In 1906, Frederic Clemson Howe published his short work, The Confessions of a Monopolist. Howe, more than a century ago, could see the power of money, a power that could certainly rise to god like status over men and women.

“Long before my election to the Senate I learned two things pretty thoroughly. One was, if you want to get rich – that is, very rich – in this world make Society work for you. Not a handful of men, not even such an army as the Steel Trust employs, but Society itself. The other thing was, that this can only be done by making a business of politics. The two things run together and cannot be separated. You cannot get very rich any other way.”

It would appear that we have created the tools, where the idea of “unlimited debt based money” coupled with computers trading at the speed of light, have truly given individuals the sense that they have attained god-like status, and Mammon has provided a sense of power like nothing else. Yet that concentration of power, has already proven to be a huge negative at the societal level…. and we are still today watching financial markets recording “highest in history” price levels!

The Results of Unlimited Mammon

Virtu’s Second Attempt At Going Public Reveals Why FX Trading Is Now Impossible, Zero Hedge, April 6, ’15

“As Virtu Financial (a high frequency computer trading firm) stated (shortly before its IPO went public April 2015), ‘The overall breadth and diversity of our market making activities, together with our real-time risk management strategy and technology, have enabled us to have only one overall losing day during 1,485 trading days.’

As we reported back in February, ‘not only did Virtu not have a trading day loss in all of 2014, but on its “worst” trading day, the firm made “only” $800,000 to $1,000,000.’”

5 Big Banks Pay $5.4 Billion for Rigging Currencies, CNN Money, May 20 ’15

“U.S. regulators hit five global banks with $5.4 billion in penalties Wednesday for trying to rig foreign currency markets in their favor.

Citigroup (C), Barclays (BCS), JP Morgan Chase (JPM), and Royal Bank of Scotland (RBSPF) were fined more than $2.5 billion by the U.S. after pleading guilty to conspiring to manipulate the price of dollars and euros…

The first four banks operated what they described as ‘The Cartel’ from as early as 2007, using online chatrooms and coded language to influence the twice-daily setting of benchmarks in an effort to increase their profits.”

Is it possible that Mammon has become the number one god we turn to daily, and if so, could there be severe consequences at the global level in the years ahead from placing so much trust in wealth that depends on ever larger amounts of debt?

Richest 1% To Own More Than Rest of World, Oxfam Says, BBC News, Jan 19 ‘15

Goldman Sachs Warns “Too Much Debt” Threatens World Economy, Zero Hedge, May 29, ’15

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate secretly and unobserved, an important part of the wealth of their citizens….As inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and lottery.” The Economic Consequences of Peace (1919) John Maynard Keynes, pg 233]

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate secretly and unobserved, an important part of the wealth of their citizens….As inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and lottery.” The Economic Consequences of Peace (1919) John Maynard Keynes, pg 233]

“I think, increasingly, they (central bankers) are discomforted. More than anything else I think it’s not just the ex central bankers but increasingly the people that are still holding the levers. They are starting to ask whether they have somehow been backed into a place where they don’t really want to be. Now, I agree with you, Sean, that there’s an element in everybody, although some more than others, where they’re glad to be looked upon as the saviours of the day. But I rather sense that an increasingly large number of central banks are actually looking at what is going on and saying ‘We are being asked to do something that is effectively impossible.'” [William White, former economic advisor to the Bank of International Settlements, in an interview with Sean Corrigan, Chief Strategiest for UK based Hinde Capital, The Road To Nowhere, An Interview with William White, Page 1, The Hindesight Letters, March 2015, pg 5]

“You shall have no other gods before Me.” Exodus 20:3

I wonder how individuals and societies will change their views toward debt based money by 2024?

A Curious Mind,