Over the last several months I have been collecting articles as well as watching market patterns from a variety of experts. Some are newer to me than others, but all have a long history. Because I see these trends converging as we go into the 3rd quarter this year, I feel compelled to share this collection of patterns with you now. For me, these are so large that collectively, they could have a global, if not historical, impact.

Since you are reading this, I doubt this sounds like hyperbole from what we have watched since 2020. Some trends span not only years, but decades. If we had time, we could unfold trends going back centuries, or millenniums if we wanted to learn from antiquity, but we must move on.

The “Golden” Rule Change at the Top of Central Banking

On July 1, 2025, the Bank of International Settlements, the global hub of all central banking, are set to make changes in what is known as Basel III, a set of capital requirements on banks globally. According to Scottsdalemint.com, these are certainly needed:

The much needed change strengthens bank capital requirements, limits leverage, and increases liquidity standards to reduce financial risk and enhance banking system stability.

Wow, and the world’s highest banking officials could not figure out that all the DEBT THEY financed and fueled between 2008 (Global Debt $173 trillion) and the end of 2024 ($318 trillion) might just create too much leverage and instability?

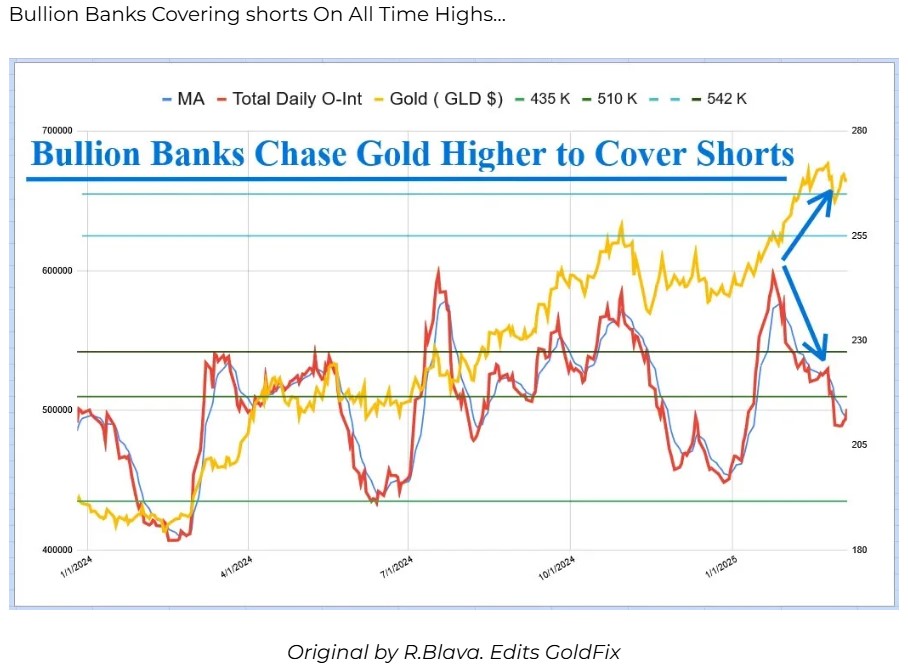

We learn that this huge change is set to go into effect on July 1, 2025. It warned all bankers and central bankers in 2021 that PAPER GOLD assets would not be seen on their books the same as PHYSICAL GOLD. The following is from an article on the US Gold Bureau website dated March 2021.

Previously, banks could hold gold on their balance sheets in the form of unallocated paper gold contracts without holding physical gold in tangible form. These paper contracts were considered as “good as gold” when it came to determining how much capital a bank needed to maintain on its balance sheet. Under the old rules, there was little incentive to hold physical gold, as it was only valued at 50% for reserve purposes. Basel III rules move physical gold from being considered a Tier-3 asset to being considered Tier-1, which allows physical gold in bullion form to be counted at 100% value for reserve purposes. Gold in unallocated paper contracts will no longer be considered an equal asset. For this reason, banks using paper forms of gold to help meet reserve requirements will have to convert those positions to physical metal, or risk becoming too undercapitalized to continue to function. [Bold and italic text mine]

[Source: Scottsdalemint.com/ Basel III Countdown: The Gold Crisis Banks Can’t Hide, 3/10/25]

While you may have come to believe early this spring that the gold flown into New York banks from the London Bullion Banks was from fear of future tariffs, the coming of Basel III regulations moving gold to a Tier 1 asset, combined with gold prices climbing sharply since 2023, FORCED them to eventually close out short positions in the gold FUTURES markets, thus having an immediate impact on them.

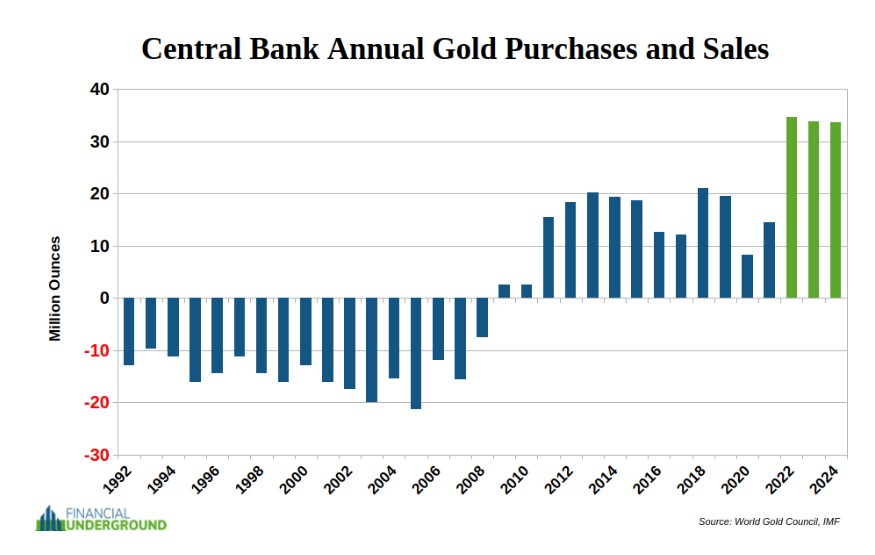

Consider these numbers from an article by Doug Casey’s International Man: The Gold Rush You Weren’t Supposed To Notice and the Next Big Monetary Reset. Every retail investor and retail advisor should examine this information and these actions by the world’s largest and most informed banks right now.

Last year, central banks purchased approximately 34 million ounces of gold, marking the third consecutive year of near-record buying….

Central banks and governments are the largest single holders of gold in the world. Together, they officially own over 1.2 billion troy ounces—out of the 6.9 billion ounces humans have mined throughout history.

Russia and China—the US’s top geopolitical rivals—have been the biggest gold buyers over the last two decades.

As we come through June 2025 and head into the 3rd quarter, I think about these words written in James Rickards 2014 book, The Death of Money: The Coming Collapse of the International Monetary System.

“Most profoundly, a new gold standard would address the three most important economic problems in the world today: the dollar’s decline, the debt overhang, and the scramble for gold.” [page 241]

Think about those 3 things: debt overhang, dollar decline, and scramble for gold. That was 11 years ago. Are these huge issues not even more impactful on our world in 2025?

In Part 2 of this 3-part series, we will look at the debt overhang and the BRICS as we move toward a term we must understand, a multipolar monetary system. The BRICS meeting in Rio de Janeiro, Brazil on July 6 and 7 may be as important to watch as the reaction to the implementation of Basel III bank changes that goes in effect on July 1st.

I know these are huge trends and issues we cannot control. However, they are influencing the world we live in and our lives. We must investigate them. We must seek to understand how they could impact us.

Back soon.

“Nothing in all creation is hidden from God’s sight. Everything is uncovered and laid bare before the eyes of Him to whom we must give account.” – Hebrews 4:13