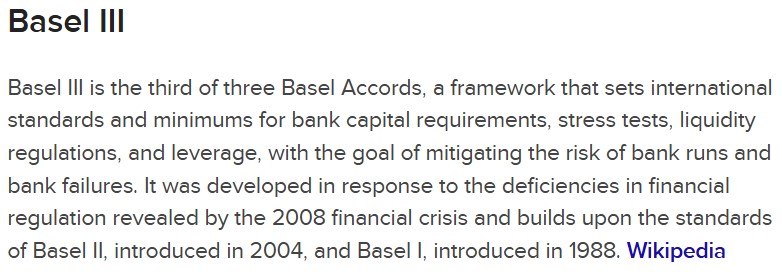

In my last post, When Various Monetary and Market Forces Converge, we looked at Basel III. As you can see from the description below, these changes have a major impact on risk management and the QUALITY of capital banks are holding. While these rules go into force on July 1st, arriving at the “third of the three Basel Accords” has taken a while.

[Basel, Switzerland has been the home of The Bank of International Settlements, the central bankers bank, and arbiter of global banking regulations.]

The next B we must look at, happens just days after the Basel III, an annual BRICS meeting that takes place in Rio de Janeiro on July 6-7. Let’s dive in.

Aircraft Carriers, Not Speedboats

When we think of “the market”, most people think of stocks. When we think of money, most Americans think of cash. Cash is classified as “risk free”. Stocks are “risky”. Yet, the value of a currency is always changing in international banking and trading, just like stocks.

To gain a better understanding of where world finance arrives as the BRICS nations meet in July, we must examine changes that have occurred at the aircraft level over years, not days.

While there are many brilliant individuals watching and speaking about this BRICS meeting and their objective of reducing the dollar’s dominance in world trade, my comments have been influenced heavily from writings of James Rickards recently, and his book mentioned in the last post, The Death of Money (2014).

What are BRICS objectives

[Source: The Rio Reset: Inside the BRICS Scheme to Hotwire the Global Economy, Birch Gold Group, May 23, 2025]

- Their main objective has been to gain power on global governance. This includes a pursuit of expanding the UN Security Council to include Brazil and India. The council would have to approve this increase to 7 seats, which if approved would give the BRICS nations 4 seats, a majority. (pg 147, The Death of Money, 2014)

- BRICS supports the SDR (Special Drawing Rights) of the IMF as a replacement for the US dollar.

- We welcome the discussion about the role of the SDR in the existing international monetary system including the composition of the SDR’s basket of currencies. (pg 149, ibid)

- Rickards boils this down to one theme: “the diminution in the dollar’s international role and a decline in the ability of the United States and its closest allies to affect major forums and in geopolitical disputes. (pg 150, ibid)

What are NOT BRICS objectives for this Summit

- The BRICS nations do not have a free-trading area like the European Union except on a bilateral basis. (pg 147, ibid)

- BRICS will not be announcing a new currency. (The BRICS Go Their Own Way, James Rickards, The Daily Reckoning, 5/31/25)

- Since there is no unified currency for the BRICS like the EU, the concept of a regional currency backed by gold is not in the works.

- BRICS does not have a military alliance like NATO.

- There is nothing on their agenda about abandoning the US dollar.

What trends of the BRICS nations will continue

- The BRICS nations will continue to use their own currencies when trading between each other. The US dollar has now declined to one third of trading among BRICS nations. This means that, “national currencies already account for more than 65%” between the BRICS nations. (BRICS Slashes US Dollar Use to One Third as Local Currencies Surge in Trade, Bitcoin.com New, 4/30/25)

- The most important item will be to increase the number of new members and add new countries.

Big for US, Big for BRICS

- With all the remarks about the end of the US dollar, it still represents 60% in global banking reserves and 80% of global energy purchases.

- BRICS have been massively building up their supply of gold, a Tier 1 asset for their central banks. Below are changes in official holdings since 2009. ((The BRICS Go Their Own Way, James Rickards, The Daily Reckoning, 5/31/25)

- Russia – gold reserves have increased from 531 metric tonnes (mt) to 2,333 mt.

- China – increased gold reserves from 600 mt to 2,293 mt

- Indian – increased gold reserves from 358 mt to 880 mt

Conclusion

The biggest problem with the financial picture we are all watching today, is that these 4 major countries – Germany, France, Japan, and the United States – have seen their major stock indices reach their highest levels ever in June 2025, or have stalled in the last 15 months. This does not mean they will not continue to climb over the short term. However, when we consider that we are now 16 years since the 2009 low, AND we have yet to see a decline in the S&P 500 last more than 7 WEEK period, RISK planning must be on every investors mind.

Will the stricter capital requirements by the Basel III requirements and the actions of BRICS nations in the second half of 2025 have a major impact on global financial markets?

My next post will be the last B, bonds. We will return to trends I have talked about since 2020. They are like gravity, a force that is above the power of mortals to control.

Who has directed the Spirit of the LORD, or as His counselor has informed Him?

With whom did He consult and who gave Him understanding? And who taught Him in the path of justice and taught Him knowledge and informed Him of the way of understanding?

Behold, the nations are like a drop from a bucket and are regarded as a speck of dust on the scales; Behold, He lifts up the islands like fine dust.

Isaiah 40:13-15