In the fall of 2013 I released a public article called “Who Needs God, We Have Bankers”. Over the last 2 years I have often thought of changing the title and releasing it again, but the power of the eternal snooze button from financial reality has stopped me.

After recent events, it seemed time to review the idea of “unlimited debt brings ‘stability’’; go back to sleep”.

The Snooze Button

The one thing about time, is like gravity, there are rules everyone plays by and always will.

Yes, debts had piled up in the trillions since 2013. Yes, it has produced the “wealth effect” assisted by various repetitious algorithmic suppression games, thus creating an even more powerful nirvana in the minds of people.

But the rules of markets and life have not changed since 2013. Thus, the value of asking questions instead of accepting the status quo become even more valuable with each passing year in this central bank/ state promoted mania.

First, let’s review the snooze button from the Oct ’13 article….

“The snooze button; what a great invention. When you have awakened from a deep sleep, and know you can get ready in less time, just hit the snooze button. You know it will still awaken you for your test or to get ready for your 8:00 flight, but in the meantime, you can enjoy a few more moments of precious sleep.

However, if you keep hitting snooze and fail to look at the time, you can also awaken to find that the extra sleep has now placed you in a position where you missed the final exam or your flight. The rewards for a few extra moments of sleep have suddenly become very costly.”

…and how Quantitative Easing (or hyper money printing to buy up assets) by central bankers has created the effect of a snooze button among investors worldwide. The higher the prices, the more the sleep, yet higher risk brings a greater need for an alarm to ring.

“Since the largest collapse of financial assets in history in 2008, the major central banks in the world, the Bank of Japan, The People’s Bank of China, the European Central Bank, the Federal Reserve, and the oldest of this group, the Bank of England, have worked together to create the largest asset bubbles ever seen while keeping the public in a perpetual state of blissful sleep. The method is actually quite simple.

Offer ultra-cheap credit to the global banks by which they can go promote even wilder speculation. Allow extreme levels of leverage in the system, something the general investor seems to never be aware of along the way. If things start looking weak, make certain the standards for collateral against those loans for speculation are LOWERED, allowing even more reckless behavior into the system.”

Now I ask you, were these statements from my October 2013 article correct at that time? If so, based on the actions of these central banks since 2013 it becomes even more important that we understand them in 2017.

If, so, then it must be true that we have more debt in the world today, higher asset values, more complacency, and greater risk not only our money, but our day-to-day use of it.

Let’s compare the stats.

Fall 2013, Summer 2017

December 1913 – Federal Reserve Act passed, establishing the Federal Reserve. US National Debt, $3 Billion

Fall 2013 – US National Debt – $17,000 billion (17 trillion)

Summer 2017 – US National Debt – $20,000 billion (20 tr.)

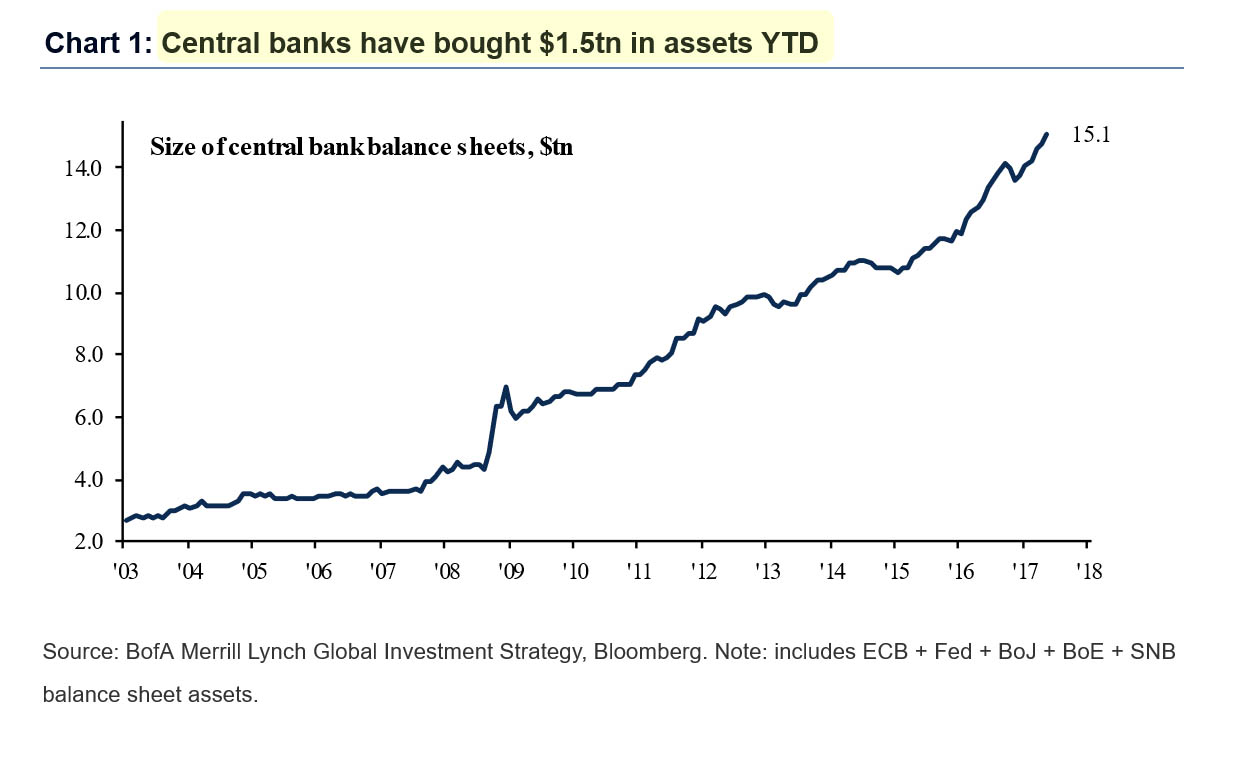

October 2013 – The combined balance sheet assets of the European Central Bank, the Federal Reserve, the Bank of Japan, the Bank of England, and the Swiss National Bank had reached $10 trillion. [Remember, this does not include the People’s Bank of China.]

May 2017 – The combined assets of these 5 major banks had reached $15 trillion.

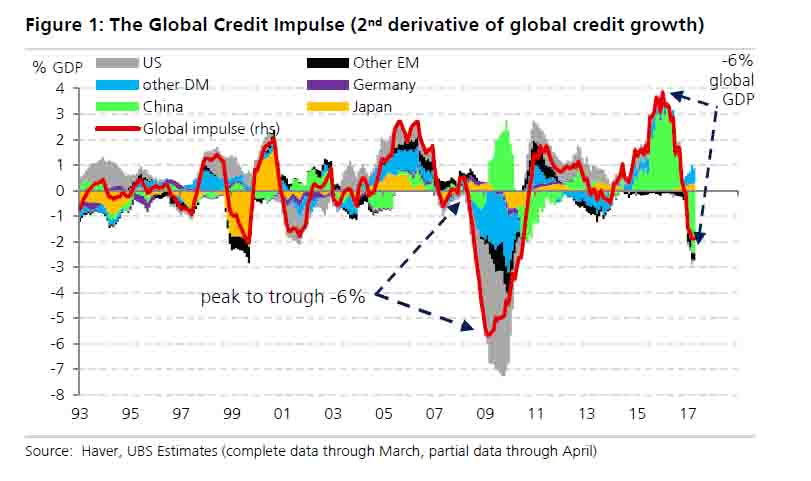

The one thing that has become very clear in the summer of 2017, is that US equity markets since the fall of 2013 are substantially higher, the US national debt is more than twice what it was at the October 2007 top ($9 tr.), the NASDAQ 100 has climbed almost 5 times the level it stood 8.5 years ago, five of the major central banks have purchased 50% more in assets than they had in 2013 with debt they created out of thin air, and the global credit growth has contracted sharply since 2015.

Does this look like “financial stability”?

Is it time we should be asking, “Who Needs Bankers, We Need God”?

UN Wants Global Currency To Replace Dollar, UK Telegraph, Sept 7 ‘09

The IMF’s SDR; Only Way to Combat the Next Financial Crisis, Business Insider,

Oct 26 ’16

Time for Discussions on the Moral Ramification of “Unlimited Money”?

Have we placed our “faith” in global central bankers, global political meetings and think tanks to take care of the “big stuff” so we can go about our own lives and plans? If so, have we allowed these global groups to become our gods?

When will it be time to return to the past and question the moral ramifications of “unlimited debt” exchanged for artificially inflated “riches”?

Ponder these quotes. Are they not relevant to us today?

“We must not let our rulers load us with perpetual debt. We must make our election between economy [thrift] and liberty or profusion [abundance] and servitude. If we run into such debts as that we must be taxed in our meat and in our drink, in our necessaries and our comforts, in our labors and our amusements, for our callings and our creeds… our people must come [will have] to labor sixteen hours in the twenty-four, give the earnings of fifteen of these to the government for their [the government’s] debts and daily expenses, and the sixteenth being insufficient to afford us bread, we must [will] have no time to think, no means of calling the mismanagers to account, but be glad to obtain subsistence by hiring ourselves to rivet their chains on the necks of our fellow-sufferers.

If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around them [the banks], will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered.” – Thomas Jefferson

“He who oppresses the poor to make more for himself or who gives to the rich, will only come to poverty.” – Solomon, Proverbs 22:16

“Government printing press money distorts economic reality, dilutes morality and is the true source of “income inequality.” Financial speculation rises with the increase in paper money and the general work ethic deteriorates. The something-for-nothing mentality pervades society.” – Bob Livingston, Personal Liberty, The Immorality of Paper Money, July 14 ‘14

“The argument that money is apolitical and amoral is equivalent to saying: we are wealthy and powerful not because the system is designed to concentrate wealth in our hands but because we are lucky, talented and/or divinely deserving”. – Charles High Smith, Why Our Status Quo Failed and Is Beyond Reform (2016), Location 678, Kindle Edition

“ And He told them a parable, saying, “The land of a rich man was very productive. And he began reasoning to himself, saying, ‘What shall I do, since I have no place to store my crops?’ Then he said, ‘This is what I will do: I will tear down my barns and build larger ones, and there I will store all my grain and my goods. And I will say to my soul, “Soul, you have many goods laid up for many years to come; take your ease, eat, drink and be merry.”’ But God said to him, ‘You fool! This very night your soul is required of you; and now who will own what you have prepared?’ So is the man who stores up treasure for himself, and is not rich toward God.” – Jesus Christ, Luke 12:16-21

A tired, but curious mind