The last time I posted a blog on living2024 was at the end of 2017. I know, a long gap between posts. However, 2022 is proving to be unlike the last 4 years.

These were the comments from the opening of that 2017 post:

“By 2024, global risks from flagrant financial bubbles in 2017 will have been recognized. For today, one can only seek to influence those willing to think outside the conventional, “‘they’ will take care the big problems” view.

We have just completed the first half of 2022. With consumer confidence hitting its lowest reading since the 1970s in June, it is a good time to review where history has taken us all through the lens of debt growth and stock levels once more. I believe there is a growing understanding that what is taking place across the world is more than just our own stories; it is a major point in history.

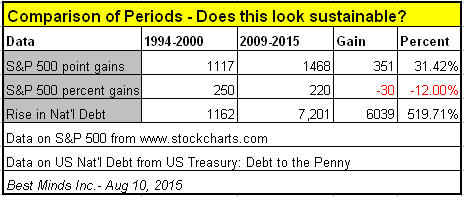

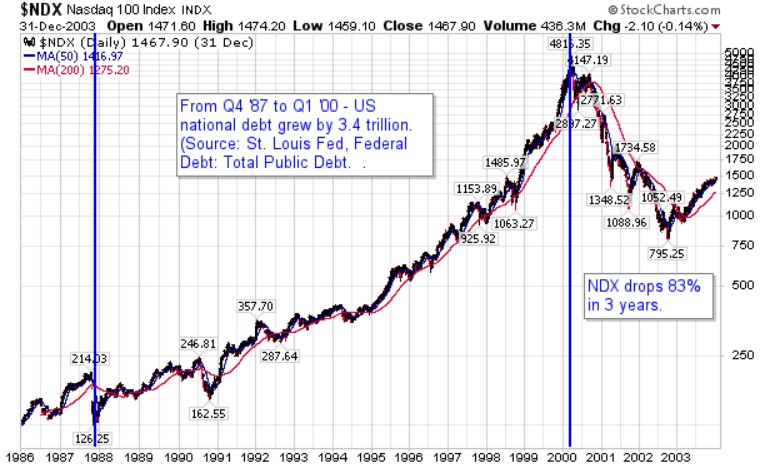

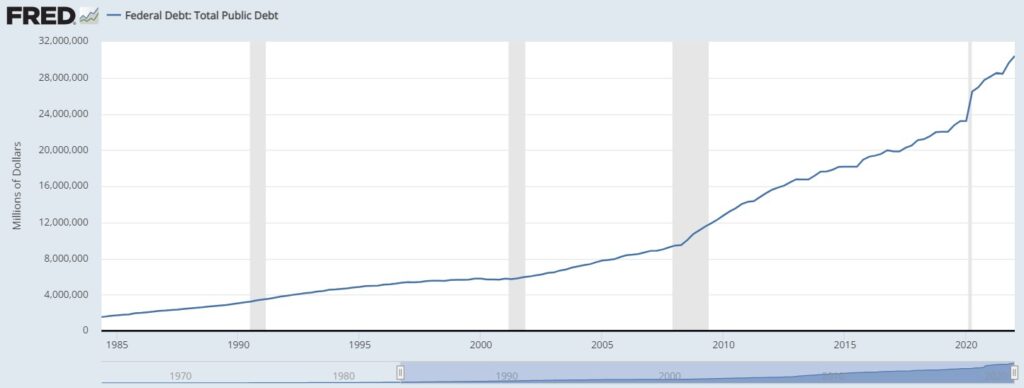

There are 3 things not seen since 2009: 1) the longest bull market in the NASDAQ on record, AND 2) the US national debt over 5 times the amount seen in the 1990s, AND 3) a 6-month period where the NASDAQ 100 has traded below its 200-day moving average.

At this point you are either saying, “NOT AGAIN””, or “It always comes back”. But this is not just about the world’s stock markets since most people around the world have no financial interest in stocks. Yet the rise and fall of markets is part of the global economy, and that impacts the lives of almost everyone around the globe.

No matter what your race, nationality, or economic status, for the last half century, the world has been living through the myth of “with more debt and state assistance, we can get back to normal”. Looking at comments coming from those sitting in their globalist chairs, there is no solution that does not include increased control over the lives of billions influenced by their decisions.

Federal Reserve Announces ‘Global Digital Currency’ to Replace US Dollar, EU Times, June 18, 2022

Countries That Have Tried Universal Basic Income 2022, Website: World Population

China launches app for its own digital currency as it looks to expand usage, CNBC, January 4, 2022

Report: America Has a Social Credit System Much Like China’s, Futurism, August 27, 2019

If you have read this far, don’t stop. Keep reading!

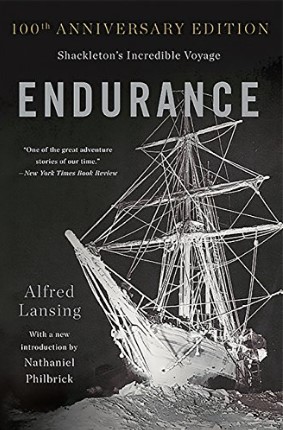

About 20 years ago, I heard about a book from Dr. James Dobson, founder of Focus on the Family. He stated that outside of the Bible, the best book he ever read was Endurance: Shackleton’s Incredible Voyage. [Short timeline of key dates during the expedition]

When I started the book, I continued to read until I reached the part where they had to depart from the ship because the ice was breaking it apart. With no way of contacting the outside world in 1915 and winter setting in on these men, you knew the story could only get much worse. I stopped reading it. I went to the final chapter. I had to see the end of the story before I could go on.

Reading the final days of triumph over some of the roughest seas on earth in one of the lifeboats, to then climb 32 miles over a steep alpine terrain, revealed that they reached a whaling station at South Georgia Island. Knowing the crew was rescued, I returned to read what was one of the greatest stories of determination and survival.

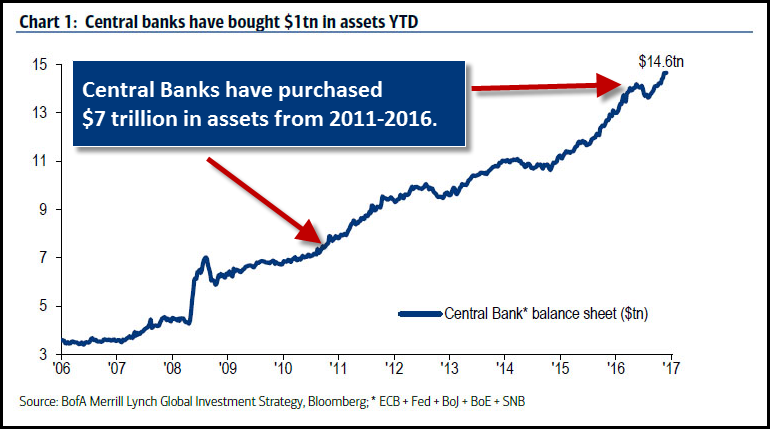

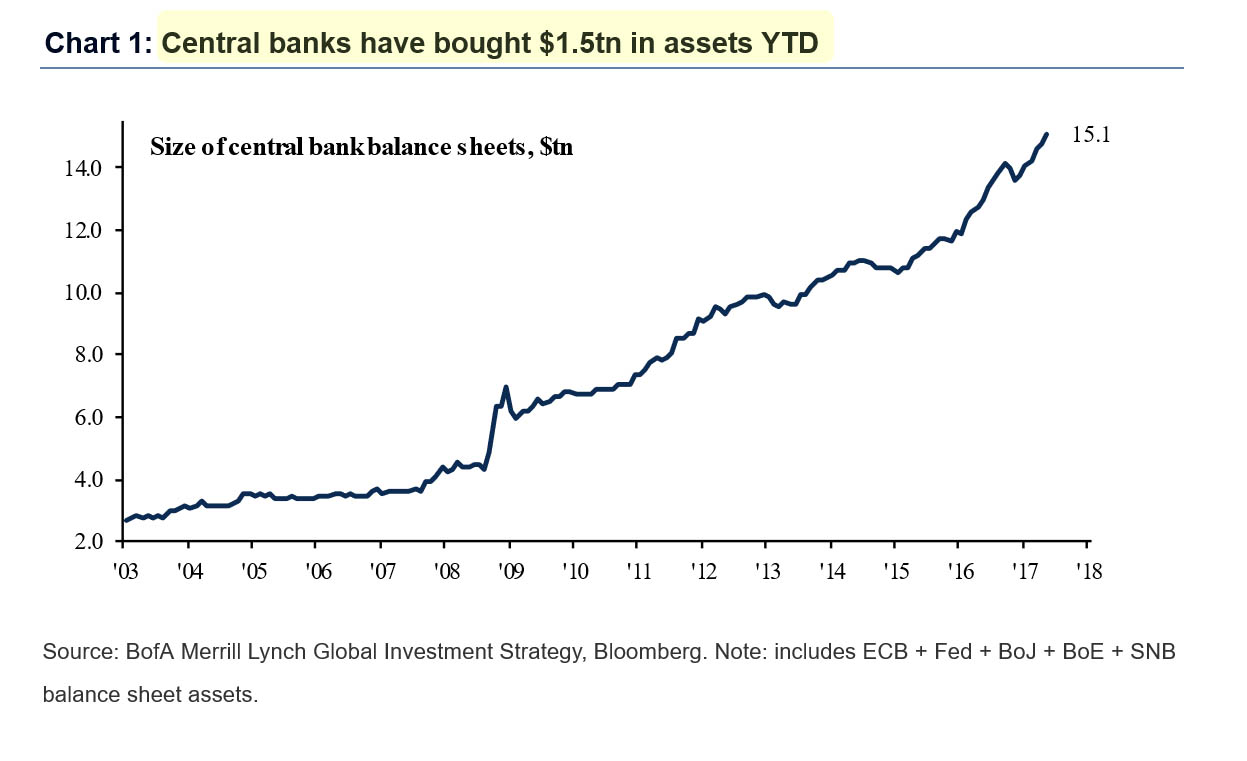

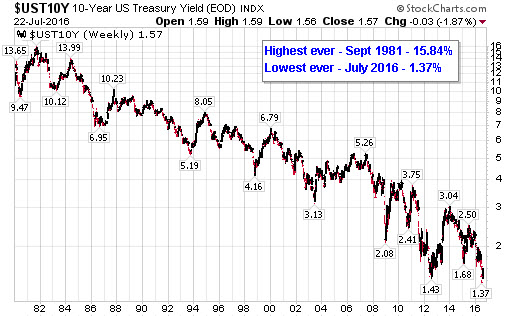

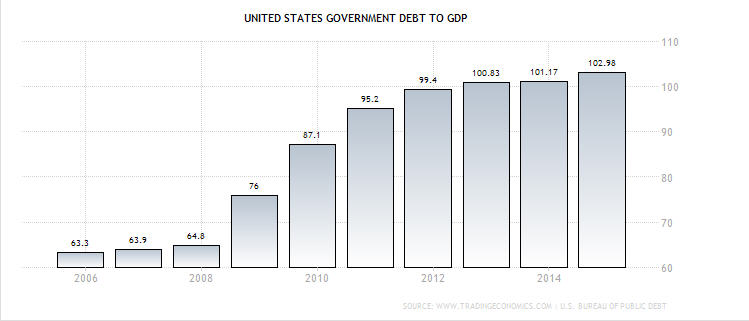

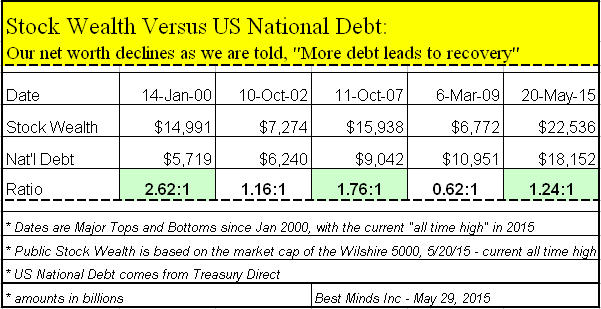

It is now 2022. We have lived through the growth of the US debt levels by $277 BILLION a year between the ’87 bottom and the ’00 top (12.25 years). We have seen these numbers leap over $7.2 TRILLION ($3600 BILLION per year) between Q1 ’20 and Q1’22. The speed of “money printing” has exploded the US debt in the last 2 years to a level that has been THIRTEEN TIMES that of the 1990s.

How could anyone believe this is the path toward, “sustainability”??!!

No matter what you hear from the world’s largest central banks and global elite forums, the reality is we are all facing historical cycle and historic changes that no bureaucrat can stop. The myth is being crushed, even as it is being promoted even louder.

“Okay Doug, but when do we get to the good part of this story?”

If you need to, jump to my closing remarks and read the extra sources. Then come back and continue reading and thinking. This is not intended to be a quick read.

We press on.

The Present and the Past: Any Connection?

At this point, I want to share with you some of my thoughts about this period from a deeper level. This comes from the last 2 decades of my life and many hours thinking of the period of history I find myself.

Anyone who has been watching the global historical view for the last 25-50 years certainly understands that our world is changing, and some things, not for the better. These changes are also coming faster, as we have seen since the start of 2020.

“Many of us are pondering when things will return to normal. The short response is: never. Nothing will ever return to the ‘broken’ sense of normalcy that prevailed prior to the crisis because the coronavirus pandemic marks a fundamental inflection point in our global trajectory” Covid-19: The Great Reset, Klaus Schwab, 2020

I would agree with Mr. Schwab’s statement. However, I would NOT agree with his solutions.

When studying financial markets, traders and investors look for patterns. As we live in a world of rapid change, is there anything from history past, that help us understand the history unfolding around us?

The following are 3 major trends that have been developing for decades. They seem to relate to the writings of Jewish men from the 1st century AD and prior. Let’s consider them together.

1) Today: At the start of the 20th century there was no United Nations, Federal Reserve, International Monetary Fund, Bank of International Settlements or World Economic Forum. When one considers the planning and actions taken from the UN’s 1992 document, Agenda 21, and more recently, Agenda 30, as well as “The Great Reset” (WEF short video and post in June 2020, and Klaus Schwab’s book (July 2020), it is clear that at the global level of governance, history is not “just one damned thing after another”. [Actually, Arnold J. Toynbee believed there were grand patterns in history.].

Someone is always planning for the future, whether at the individual level or global.

Do you believe we are moving toward a world that protects national sovereignty and the rights of the individual, or a global governing structure that supersedes national sovereignty and human rights decided by small unelected global committees? How could that change our lives?

1st century AD: John, the author of the book of John and Revelations in the New Testament, a disciple of Jesus.

“And the dragon stood on the sand of the seashore. Then I saw a beast coming up out of the sea, having ten horns and seven heads, and on his horns were ten crowns, and on his heads were blasphemous names.” Revelation 13:1

While I have seen maps allegedly developed by the Club of Rome demonstrating how nation states have been grouped into 10 regions, the interesting thing is that the term, “ten horns”, is described 3 times in the book of Daniel (6th century BC), and 4 times in Revelation (1st century AD). From the notes in the John McArthur Study Bible about Revelation 13:1 we find:

“Ten is a number that symbolizes the totality of human military and political power assisting the beast (Antichrist) as he controls the world. Horns always represent power, as in the animal kingdom…”

The Jewish writers of the Old and New Testament produced their writings while living under 6 world empires. I know of no other book that is a collection of writings spanning 1500 years and during 6 world empires. Could this be of value to understanding our world today?

2) Today: If you have every watched the British archaeology show Time Team (1994-2014), you have probably seen a dig where they found Roman coins from the 1st-3rd century. The United States minted its first coin in 1793. We even find Abraham paying 400 shekels of silver for a piece of land to bury his wife Sarah in Genesis 23. This would have taken place around 2,000 years before Christ. Money in the form of a metal coin has a very long history. However, fiat currency is what most of us know as money today.

With the advent of debit cards and apps for smartphones, money has become an electronic swipe. This is the first time in history for societies to ever see this behavior. As such, we are becoming more and more disconnected from the reality of HOW money is formed and what that could mean to our futures.

Away from the smartphone and debit card level, is the top of the global level. The next “tool” to help “stabilize the financial world”…how’s that going…is a digital currency by the world’s most powerful central bankers. What is this? It is an experiment by central bankers. Consider these headlines:

China’s CBDC Has Been Used for $9.7B of Transactions, CoinDesk, Nov. 3 ‘21

Japan’s digital yen plan to become clearer late 2022, says ruling party official, Reuters, July 4 ‘21

The digital euro and the evolution of the financial system, European Central Bank, Speech, June 15 ‘22

Remarks by Chairman Powell at the International Roles of the US Dollar Conference, You Tube, June 23 ’22 (Focus on 3:32-4:12)

Tie this into the 5 currencies that make up the only international monetary unit, the Special Drawing Rights (launched in 1969). If these banks continue gaining more control through digital currencies and the Special Drawing Rights, they will have even more power over transactions globally.

“A basket of currencies defines the Special Drawing Rights: the US Dollar, Euro, Chinese Yuan, Japanese Yen, and the British Pound.”

Add to these developments ideas discussed in this interview with Catherine Austin Fitts, and this becomes even more disturbing. Fitts has a long history of watching and informing the public regarding changes at the global level of money. Big point: We are moving toward global control of all financial transactions.

Catherine Austin Fitts, Planet Lockdown, Jan 7 ‘21

1st century AD: John, the author of the book of John and Revelation in the New Testament, a disciple of Jesus.

These are probably the most widely known verses from the book of Revelation. Is it possible these words have anything to do with the current historic trends we see unfolding around us?

“And he causes all, the small and the great, and the rich and the poor, and the free men and the slaves, to be given a mark on their right hand or on their forehead, and he provides that no one will be able to buy or sell, except the one who has the mark, either the name of the beast or the number of his name.” Revelations 13:16-17

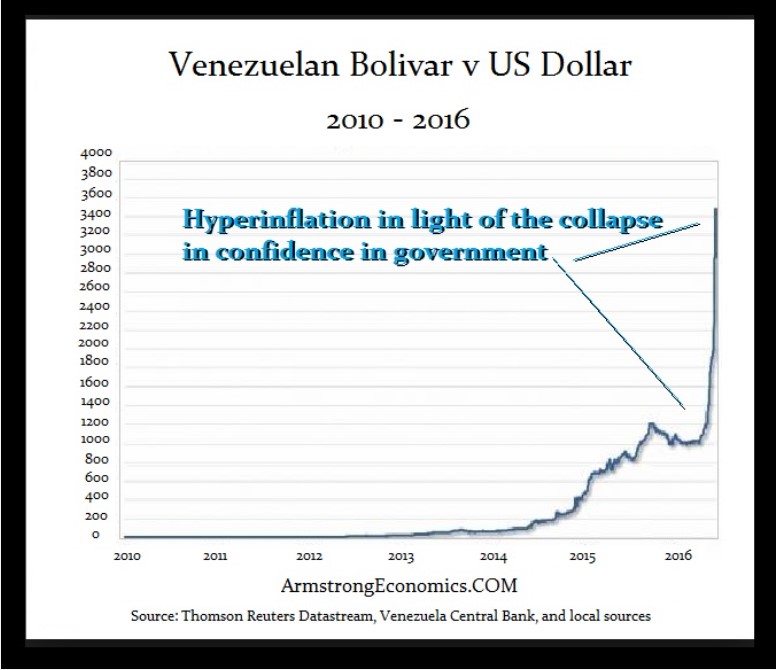

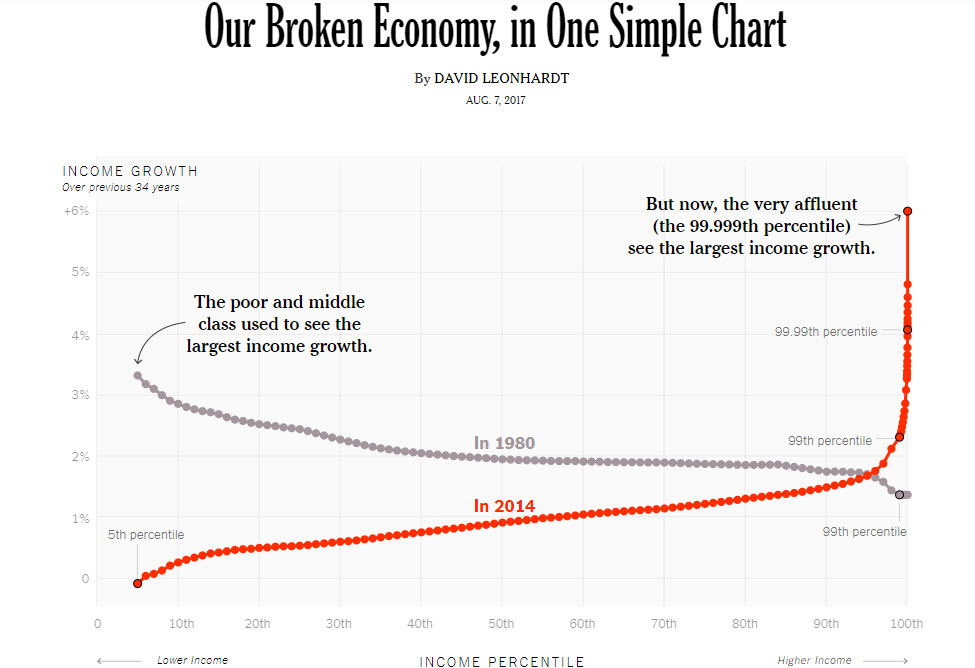

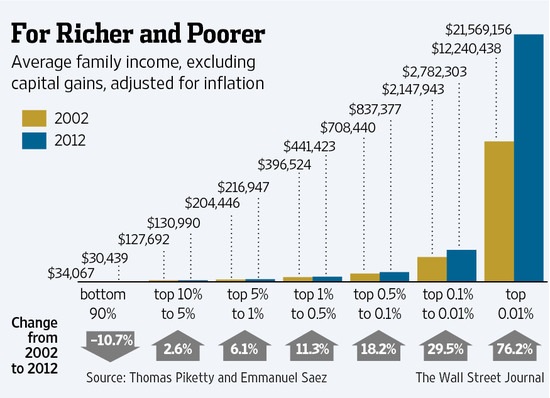

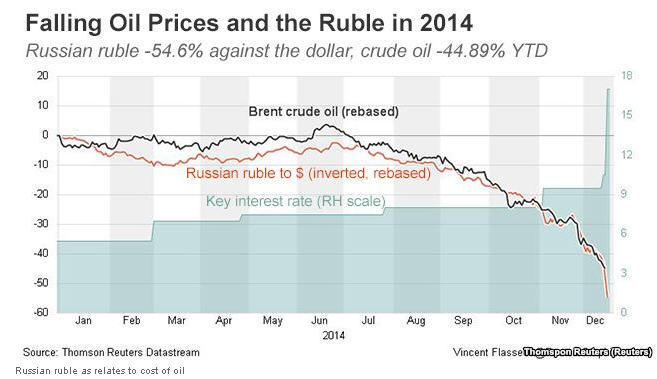

3) Today: If there is one thing felt by almost everyone across the world, it is the reality of inflation and the impact on their lives from the devaluation of their money.

US producer prices soar 10.8% in May as cost of gas spikes, NY Post, June 14 ‘22

‘It is really bad’: Nigerians go hungry as food inflation soars, Al Jazeera, April 16 ‘21

Inflation accelerates across Asia as experts warn of higher prices to come, The Start, July 7 ‘22

While we may not have experienced hyperinflation ourselves, it has left many painful stories over the last hundred years.

10 Hyperinflation Horror Stories of the 20th Century, Business Insider, Mar 19 ‘11

Venezuelan Hyperinflation, Armstrong Economics, Nov. 30 ‘16

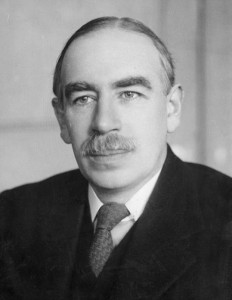

Even one of the most studied economists of the 20th century, John Maynard Keynes, gives us insight into the ROOT of the trouble with monetary instability in his book, The Economic Consequences of Peace (1920):

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some…. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency…” [Pgs 235-236]

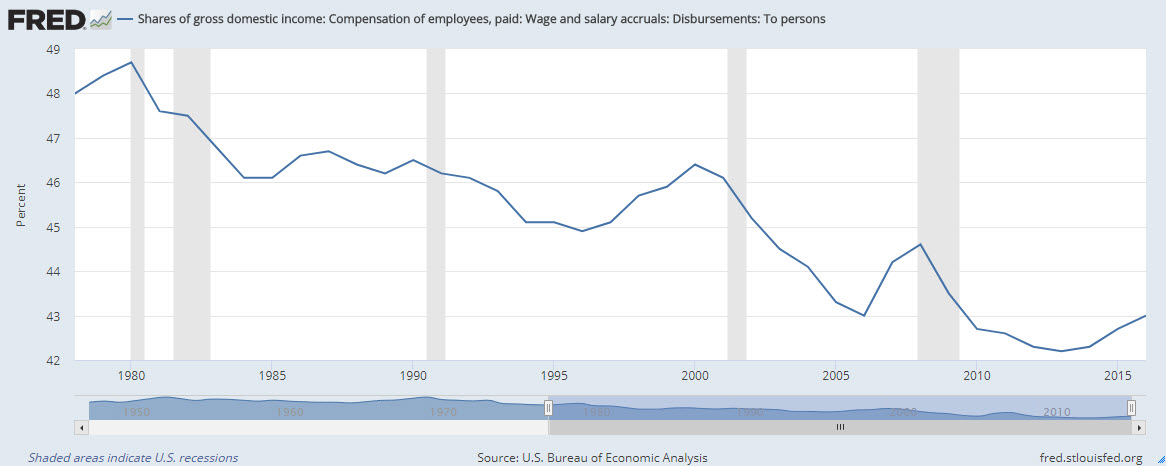

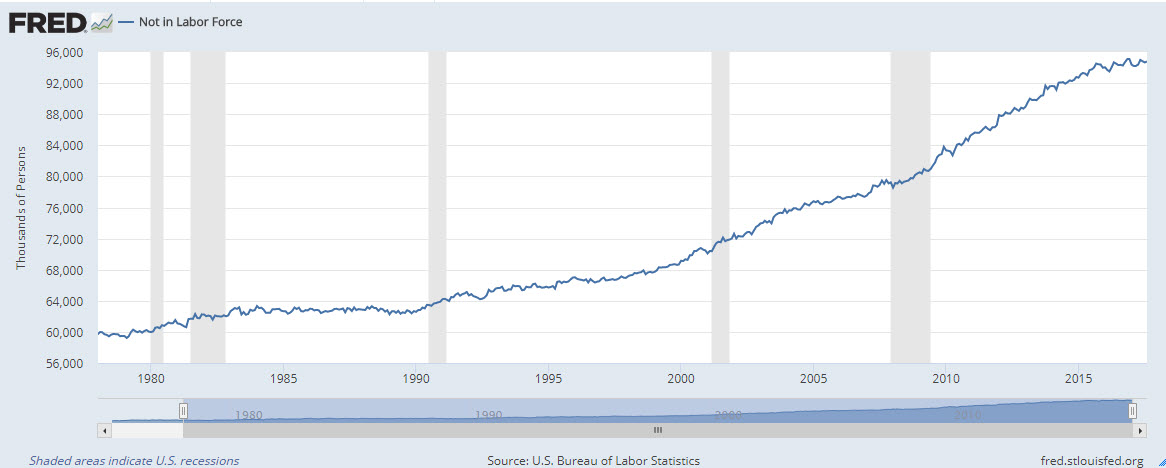

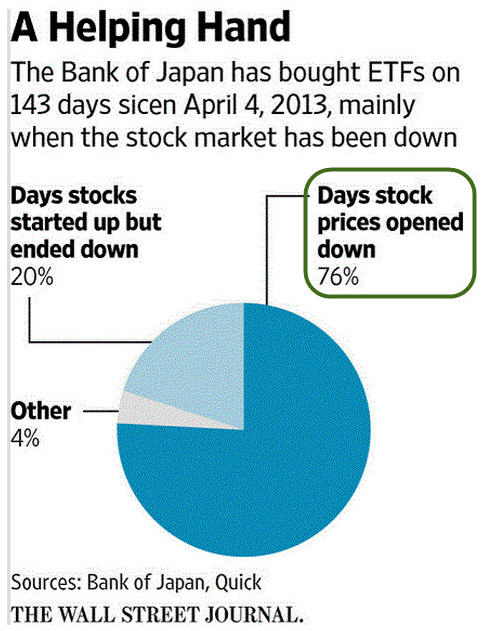

Central bankers, as shown from their actions, have yet to address the problem they are creating by always solving a financial crisis with MORE DEBT (or up next… digital money or CBDC).

“It might thus provoke changes that would have seemed inconceivable before the pandemic struck, such as new forms of helicopter money (already a given), the reconsideration/recalibration of some of our social priorities and an augmented search for the common good as a policy objective…” [Covid 19: The Great Reset, Klaus Schwab & Thierry Mallaret, Introduction, July 2020, highlighted text mine]

1st century AD: John, the author of the book of John and Revelations in the New Testament, a disciple of Jesus.

In the spring of 2007, I met with Dr. Dwight Pentecost, an author and professor who taught at Dallas Seminary for 58 years. He was in his early 90s when we met. We talked for about an hour and a half. It was like talking with a young person, yet with someone who had spoken with people all over the world who was constantly learning.

Since the two books of the Bible most known for their eschatological content are Daniel and Revelation, he told me that he believed that Revelations 6: 5-6 implied a period of hyperinflation.

“When He broke the third seal, I heard the third living creature saying, ‘Come’. I looked, and behold, a black horse; and he who sat on it had a pair of scales in his hand. And I heard something like a voice in the center of the hour living creatures saying, ‘A quart of wheat for a denarius and three quarts of barley for a denarius; and do not damage the oil and the wine.’” Revelation 6:5-6

The John McArthur Study Bible provides commentary that parallels Pentecost’s comments:

“quart of wheat. The approximate amount necessary to sustain one person for one day. denarius. One day’s normal wage. One day’s work will provide enough food for only one person. three quarts of wheat. Usually fed to animals, this grain was low in nutrients and cheaper than wheat. A day’s wage provides enough for only a small family’s daily supply.”

The following comment and image were found in a paper titled, “The Use of Propaganda on an Augustan Denarius” [All Undergraduate Student Research, Pepperdine University, page 79, 2013]

Closing:

In the first section of this post, I spoke about the book, Endurance: Shackleton’s Incredible Voyage. When the story came to the point where the men had to abandon ship as winter was coming in Antarctica, I had to read the end of the story. Only then, did I return to see how they made it.

To me, the answers to God size problems, is GOD. I know some of you will disagree with me. This is fine and is the basis of free speech and thought. We can have a discussion. We can help each other.

However, it is clear to more and more people that the freedom to have a thought or comment apart from “the information” continues to only be seen as “disinformation”. This is not freedom. This is an Orwellian pathway. This is NOT the right road!

I will continue to write and seek to impact the thinking of others. I will continue to listen to the ideas of others and seek to learn.

To me, it is the only path forward and away from tyranny. To me, the only source powerful enough to deal with a world run by those pushing for more power and control, is a GOD size solution. To me, this is the only way we ever arrive at true lasting peace and respect for all.

The sources listed in the Extra below, are ones I have read many times over decades. I encourage you to read them all if you are unfamiliar with them.

Thank you for taking the time to consider this material.

Extra: Pieces of a GOD size story of hope

- Why did Jesus come? John 3:16

- Why do we need GOD? Romans 3:23

- Is there a price for rejecting GOD? Romans 6:23

- Is there a bridge that allows man to connect with the Divine? Romans 10:9-10

- Where can one find hope of a GOD size rescue? I Thessalonians 1:9-10, 4:13-18, 5:9-10, I Corinthians 15:51-52

- Are there any words about a future time of global peace and rest? Revelation 20:1-3, 21:3-5

Feel free to leave comments about this post, whether pro or con.