By the year 2024, I am certain no one will think it odd for massive sums of debt to lead to enormously negative consequences across societies. By then, history will be replete with stories from this period. However, after living through the largest growth in global debt in a 6 year period, it seems that most either do not know, or want to consider, how much the nations of the world are depending on central banks to always be ready to pour trillions of debt on top of current levels, thus somehow keeping things “normal”.

By the year 2024, I am certain no one will think it odd for massive sums of debt to lead to enormously negative consequences across societies. By then, history will be replete with stories from this period. However, after living through the largest growth in global debt in a 6 year period, it seems that most either do not know, or want to consider, how much the nations of the world are depending on central banks to always be ready to pour trillions of debt on top of current levels, thus somehow keeping things “normal”.

Of course, anyone willing to look at world markets from a historical basis understands that what the world has seen since 2008, has never happened at these extremes. To believe that this level of “assistance” has brought things back to “normal”, is to defy the lessons on debt from history.

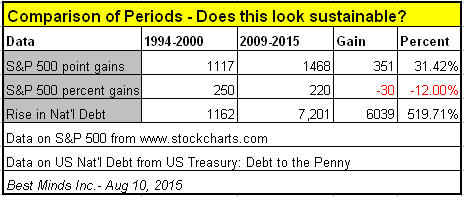

Look at the chart that opens this piece. Remember the launching of the internet in the 1990s and the explosion in tech and telecom stocks from the late ’90s? From the low in 1994 to the high in 2000, the S&P 500 – a collection of 500 of the largest companies based in America – climbed 1117 points, or 250%. During that time, the national debt grew by $1.16 trillion.

Now look at what has taken place between the 2009 low (March) and 2015 high in the S&P 500 (May). Regarding points gained, this widely used stock yardstick gained 1468 points, adding 31% more than the amount produced in the late ‘90s. However, percentage wise, it was actually 12% less than the late ‘90s run.

But all investors should be focused not on what was made in stock gains, but the skyrocketing costs of “stimulus” added to the US national debt during this period. In the recent 6 year run, the US national debt soared $7.2 trillion, compared to $1.16 trillion during the 6 year run in the late 90s, an increase of 519% over the previous bull market run!

Now THAT is a whale of a lot of “assisting”.

Without the Federal Reserve’s QE I, II, and III, to “stimulate” the markets that were suppose to then stimulate the economy, the debt levels would have never risen this fast.

Enjoy the Party Today; the Hangover Can Always Be Stalled… Right?

Most of 2015 we watched the Dow vacillate up and down through its 18,000 level. While the Federal Reserve’s QEIII had stopped last October, there was the belief that the the Bank of Japan and the European Central Bank could pick up the slack this year.This proved to be the case into Q2 in their markets, but the Dow and S&P 500 had been stalling around 18,000 and 2,100 respectively all year.

With major problems hitting China (Q2 ’15), the world’s front runner in increasing its own debt levels, as well as the impact of Greece on the EU, the global slowdown finally caught up with the computer algorithms two weeks ago in global financial markets.

“Kick the can” abruptly fell into a large pothole. The “riskless” market feeling that tens of millions of investors had grown accustomed to, suddenly became the “risk full” market where investors headed for exits quickly, making record redemptions.

‘Total Risk Surrender’: Record 29.5 Billion Yanked From Stock Funds, Morningstar, 8/28/15

Even now, many articles are explaining this as another computer glitch, rather than the normal pattern among human beings that understand that after “all time high” headlines, must come the bust phase, thus seek to sell rather than ride markets back to their third major bottom since 2000.

The major central banks in this global drama – the Bank of Japan, Federal Reserve, European Central Bank and People’s Bank of China – have fostered a more than 40% increase in global debt levels since 2007 as the “solution” to the 2008 debt crisis. Why would we NOT expect serious consequences across every aspect of our societies from this global financial bubble, like what we saw from the 2008 bust?

Thinking and Acting Outside the Box

The problem with mania markets, especially where the state supports wild speculation that can not be sustained, is that history is replete with stories of financial leaders and insiders selling out at the top.

Sadly, the “it’s only a pullback”, and the “recovery” after two 50% plus declines in the S&P 500 since 2000, has tens of millions of retail investors and advisors caught up in the myth that somehow, someway, “the stock market” will always come back to these levels and climb higher. The fact that Greenspan cut rates to 1% in 2003 to create the largest housing bubble in American history seems to be of no importance to one’s personal investment plans. The fact that Bernanke and Yellen have kept a zero interest rate policy in place since December 2008, pouring more cheap debt into the system that at anytime since the nation was founded in the 1700s, seems to be something we don’t even consider when talking about personal or business financial goals over the next 5 to 10 years.

I have often wondered why so few Americans even discuss where the nation is headed financially when discussing their own finances and plans.

Make Changes & Prepare for the Bust; Help Yourself and Others

It should also be clear for anyone concerned about their finances, that when a weekly record is made in redemptions from US equity funds only one month after the highest level on record was made in the NASDAQ, that seeking to learn what the big money has been doing recently would be prudent for the smaller and less informed investors.

Billionaire Stanley Drunkenmiller Loads Up On Gold, Makes It His Largest Position For First Time Ever, Zero Hedge, 8/16/15

What good will it do as trillions in capital are lost again by retail investors and more conventional strategies, while capital continues concentrating in the hands of tiny fraction of the world? Is this really progress? If smaller investors are willing to change, and prepare for the bust rather than merely ride it to the bottom again, would this not be a better option for them and their community?

New Oxfam Report Says Half of Global Wealth Held by the 1%, The Guardian, 1/19/15

No, Billionaires Don’t Drive Economic Growth – and Crony Billionaires Strangle It, The Guardian, 7/15/15

With so much money getting ready to be moved from smaller investors yet again, providing less funds to be spent across our economy, I hope you will share this article with anyone willing to think outside the box. Time is quickly running out to bury our heads in the proverbial sand.

If history repeats itself once again, the uber-wealthy (0.5%) will merely protect or grow their wealth in the bust phase ahead, while tens of millions of smaller investors will watch what they have vanish, placing their hopes on yet one more rescue by the hands of central bankers. If only we could see the value of investing in lives as even more critical to our nation as investing in “assisted” markets.

Americans Not In Labor Force Exceed 93 Million for First Time; 62.7% Labor Force Participation Matches 37-Year Low, CNS News, 4/3/15

“And his master praised the unrighteous manager because he had acted shrewdly; for the sons of this age are more shrewd in relation to their own kind than the sons of light. And I say to you, make friends for yourselves by means of the wealth of unrighteousness, so that when it fails, they will receive you into the eternal dwellings.” – Luke 16:8-9

I believe in the period ahead, we will all want to know that there are others around us who would be willing to make sacrifices for us and they know the same from us.

“Greater love has no one than this, that one lay down his life for his friends” – John 15:13

- – On August 24, 2015, the Dow dropped 1,089 points, surpassing the May 6, 2010 flash crash. Because of the extraordinary financial period we are watching, I have linked an interesting piece written by a colleague. Whether you agree or disagree with his conclusions, I believe you will find the piece fascinating when considering the unique period in financial history we are all living through. Click here to read, The Imminent Financial Reckoning, released on August 25, 2015.

A Curious Mind