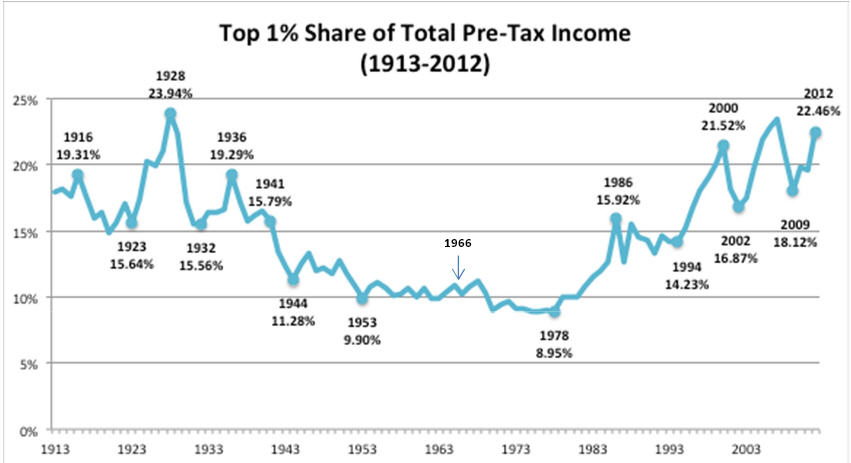

[The chart above is found on page 9 of Mat McCracken’s piece, The Imminent Financial Reckoning, linked at the end of my August post. The chart was originally released in the Quarterly Journal of Economics.]

Do you notice that the only time in the last century when the top 1% earned more as a percentage of the total nation than they did in 2012 was in 1928?

We all know what happened shortly thereafter, when the U.S. experienced the collapse of its stock market and financial institutions and the Dow plunged from its 1929 high of 380.33 (9/3) to its 1929 low of 198.69 (11/13) in less than 3 months. As the history books make clear for anyone studying this period, this 181.64 point drop (48%) was the beginning of the Great Depression. *

Eventually, tens of millions of lives would be changed by this global deflationary depression, the Dow continuing to collapse until its 1932 low of 41.22 (7/8), producing an 89% loss.

But I believe my fellow Americans not only were challenged with the extreme financial and economic conditions, but could see no way out of their current condition without the rapid expansion of the powers of the state. In other words, in the 1930s, the idea of “big government and big debt are needed in a crisis” took root. People started looking more to the state than each other and the Divine.

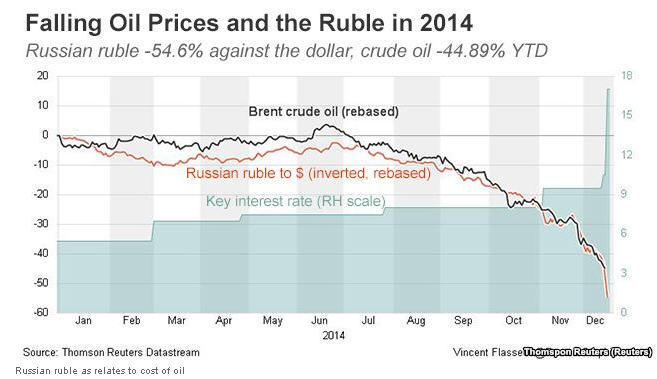

Now let’s jump forward to lessons we could have been learning these last few years, yet in a world of hurry, hurry, more, more, the idea of a massive expansion of debt and the powers of central banks in our markets seems to have gone unnoticed by the majority of the public. It is if we can not change it, why learn about it or consider the serious of all of these red flags popping up everywhere.

Yet anyone watching current events and history can see that these topics are not going away. There will be consequences.

In 2015, the income and wealth disparity has become a major topic again, due to the tens of trillions in debt that central banks around the world have poured into the global financial system in an attempt to “inflate our way out” of the problems created from the collapse of the last debt fueled bubble collapse in 2008. The issue is not a Democrat or Republican one, since it impacts all Americans, and frankly, the entire global economy.

Ted Cruz Says Top 1 Percent Earn More of National Income Than Any Year Since 1928, Politifact, Jan 30 ‘15

“…Cruz drew his comparison to 1928 from a report by the Pew Research Center citing research by Emmanuel Saez, a University of California, Berkeley economics professor who studies wealth and income inequality.

Saez helps steer the World Top Incomes Database, sponsored by the Paris School of Economics, a research center and conglomerate of French universities.”

And the problem is not merely income disparity, but wealth disparity as well. Once again, I am not promoting or seeking a big government/big bank/big debt solution, since this theme has gone on for decades and the problem only continues to worsen during every subsequent boom.

I believe the answers lie at the local and individual level, and a reboot like the year of Jubilee that the Jews were given in Deuteronomy 25 over 3,000 years ago.

I do not see this as a solution today, since the public at large, even the church, seem to start discussions of global finance at the big bank (central banks)/big government level, so that when the next “crisis is an opportunity” comes, the public should continue to seek answers from the state which has become our “god”.

“But don’t we need more government and central banking assistance?”

Let’s stop and look at the amount of wealth in the world today, backed by historic levels of debt.

A new report on the concentration of wealth was released last week by the Swiss Bank, Credit Suisse. The report states that of $250 trillion in global assets (backed by more than $200 trillion in global debt), the top 1% own 50%, and the bottom 50% own less than 1%.

To say there is no money to solve massive humanitarian needs without more government and more debt is totally insane from looking at these numbers. In my opinion, it comes from redefining human life as a greater investment than material gains, once again, something I do not see changing until another collapse into the tens of trillions in global asset values.

Consider the charts below and comments, pulled from the recent article, Top 1 Percent Own More Than Half of 1 Percent of Wealth (Global Research, Oct 14, 2015). The flood of debt worldwide from central banks since 2008 has done nothing to change these dangerous societal trends.

Whether the publication is seen as a supporter of socialism or capitalism, both discuss the same Credit Suisse data and see a problem.

The Top 1% Now Owns Half The World’s Wealth, Fortune, Oct 14, 2015

“Credit Suisse says wealth inequality was actually falling before the financial crisis but has increased every year since 2008. The U.S. created 903 new millionaires between the 2014 and 2015 report, while median wealth has stagnated. Globally the number of millionaires fell, though the strength of the U.S. dollar is cited as the biggest contributing factor to that statistic.”

Going Global Or Local: Could We See Both In the Period Ahead?

David Rothkopf, a global insider and CFR member, released the book, Superclass: The Global Power Elite and the World They Are Making, in 2008. According to Rothkopf, to be super rich in the world today takes a global view, and one that rises above such things like national sovereignty and country loyalty.

“ They will feel more affinity to their fellow global conversationalists thatn to those of their countrymen who are not yet part of the global conversation.” – Walter Wriston, former CEO of Citibank in his book, The Twilight of Sovereignty (pg 11)

“Their loyalties – if the term is not itself anachronistic in this context – are international rather than regional, national or local. They have more in common with their counterparts in Brussels or Hong Kong than with the masses of Americans not yet plugged into the network of global communications.” – Christopher Leach in his book, The Revolt of the Elites (pg 11)

As the bust phase in financial history sets in, the world will change for everyone, whether super rich, rich, middle class, or poor. If we are going to keep our civility and “love thy neighbor as thyself” is to be a part of our society, we must know our neighbors and demonstrate true compassion for people of all backgrounds and cultures around us, and that may mean doing things outside of our comfort zones.

For me personally, these ideas, written during the 1st century and taken from the pages of the New Testament, inspire me to consider human life as more important than material gains in the period ahead. It also reminds me how there are examples from that period that are highly relevant to our world today. I hope they touch your heart, no matter where your faith lies.

“ Greater love has no man than this, that one down his life for his friends” – John 15:13

“…and they began selling their property and possessions and were sharing them with all, as anyone might have need. Day by day continuing with one mind in the temple, and breaking bread from house to house, they were taking their meals together with gladness and sincerity of heart, praising God and having favor with all the people.” – Acts 2:45-47

“Now, brethren, we wish to make known to you the grace of God which has been given in the churches of Macedonia, that in a great ordeal of affliction their abundance of joy and their deep poverty overflowed in the wealth of their liberality. For I testify that according to their ability, and beyond their ability, they gave of their own accord, begging us with much urging for the favor of participation in the support of the saints…

For if the readiness is present, it is acceptable according to what a person has, not according to what he does not have. For this is not for the ease of others and for your affliction, but by way of equality at this present time your abundance being a supply for their need, so that their abundance also may become a supply for your need, that there may be equality; as it is written, “HE WHO gathered MUCH DID NOT HAVE TOO MUCH, AND HE WHO gathered LITTLE HAD NO LACK. (Exodus 16:18) II Corinthians 8:1-4; 12-15

A Curious Mind, Desirous of A Compassionate Heart

- Check out the history of all closing prices in the Dow Jones Industrial Average from October 7, 1896 to the present at Measuring Worth.com.

- Another source is the 2012 study, Pulling Apart, which examines income disparity across states between 1917 and 2011. The research was assembled by the Economic Policy Institute and the Center on Budget and Policy Priorities. (Once again, I believe the only sustainable solutions are ones that return power to the states and local communities, not an expansion of powers at the global level. A debt based money can only continue to lead to even greater crises in the years ahead, not less. The Special Drawing Rights, the international monetary unit backed by the International Monetary Fund, was expanded 8 fold in 2009 in response to the 2008 crisis. Clearly world financial leaders are expecting a massive change at the currency level as a “solution” to the next major crisis. This is why local community solutions will become very important in the period ahead.)