To the World of 2024,

It would appear that our time in this maddening central banking experiment is ticking down. For that reason, I am going to post pictures with few comments until history gives us world headlines to post.

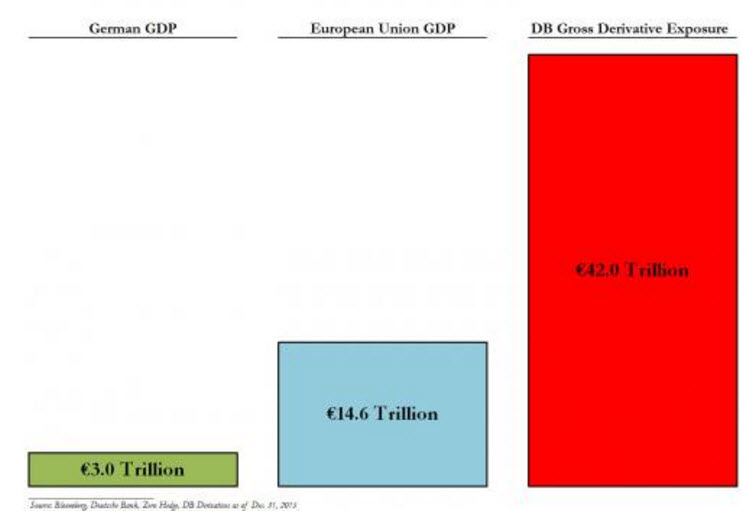

First is a picture from news service Zero Hedge, comparing the size of the derivatives book of banking giant Deutsche Bank in September 2016 with the Gross Domestic Product of the entire nation of Germany and the GDP of the entire European Union. [The Run Begins: Deutsche Bank Hedge Fund Clients Withdraw Excess Cash, 9/29/16]

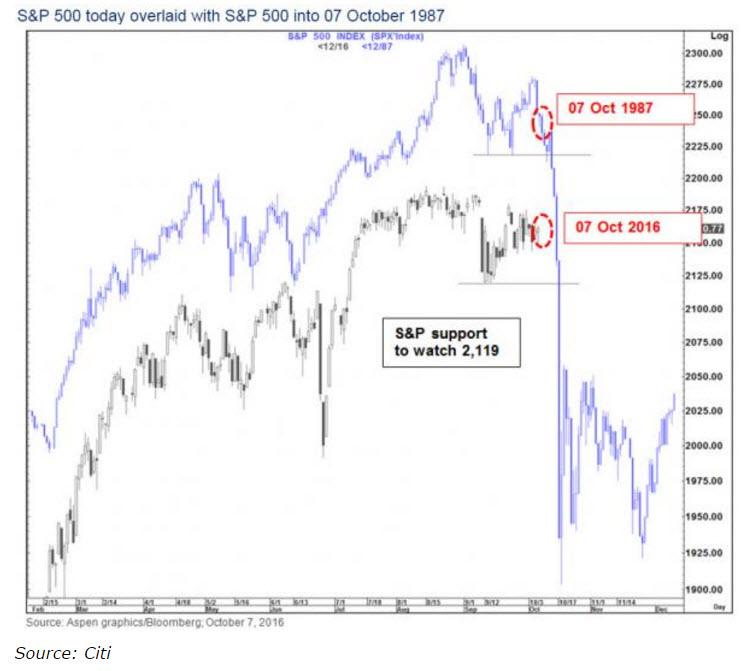

Next, is a chart from Tom Fitzpatrick of Citigroup just released. Once again, the source was a post from Zero Hedge. [The Chart That Give Citi “The Chills”, Oct 10]

The third picture reveals that on August 12, 2016 world markets saw THE lowest yield on the 10 year British Gilt ever in history, records spanning more than three centuries. These yields have risen sharply (prices falling) since then.

My next chart shows that since reaching its all time high on August 15, 2016 (18,668), the Dow Jones Industrial Average has repeatedly stopped declining after falling to its 100 day moving average on September 9th. There is no way a worldwide crowd of investors could randomly repeat a pattern at a technical line this many times. This would make sense if powerful high speed computers halted the decline around this level repeatedly.

Are we looking at the final day the Dow was above its 100 day? Could price and experience change soon?

As you look at the pictures above and the postings since 2014 on this blog, you can see why I am so concerned about the world of price illusion from central banking intervention while the global economy we all live in daily continues to slow.

Alex Weber, Chairman of global banking giant UBS, also a former President of the German Bundesbank, made these comments recently. They once again remind us that a knowledge of the financial world and history is of value, even when an experience provided by constant intervention gives us the false sense of a world without risk.

“They (central banks) have taken on massive interventions in the market, you could almost say that central banks are now the central counterparties in many markets. They are the ultimate buyers…

Investors have been driven into investments where they have very little capability for dealing with what is on their plate and I think that is a sure reminder of where we were in a different asset class in 2007.”

Hang on. The pressure to our thinking and feelings is rising.

A Curious Mind