“There is truth deep down inside of you that has been waiting for you to discover it, and that Truth is this: you deserve all good things life has to offer. You know that inherently, because you feel awful when you are experiencing the lack of good things. All good things are your birthright!” – The Secret (2007), 41 weeks in top the five NY Times Hardcore Advice List; it opens my article, Fear and Perception, released on November 1, 20017, two days after Hong Kong’s Hang Seng stock index hit its highest level ever. So much for “all good things” being a “birthright”.

Four months earlier, on Thursday, July 19, 2007, I released a group email to all paid and free subscribers of Best Minds Inc. The email stated the following:

“Evidence is mounting that we are in the final throes of this worldwide, credit-fueled bubble. The wobbling dominoes certainly merit the attention of all investors and advisors.”

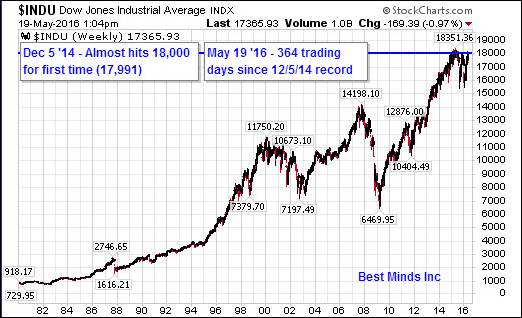

That same day, the Dow closed above 14,000 for the first time. It began its descent the next day, but roared back up to close 8 days above this level in October 2007 before starting its downward march through what is now known as the Great Recession. It would take until February 1, 2013, and the public watching the largest ongoing bailout of global banks ever, before the Dow would once again close above 14,000.

So if investors wanted to “experience” wealth, why was July 2007 a harbinger that their wealth was about to be taken from them? Because financial facts at the top of financial bubbles are very different from financial feelings.

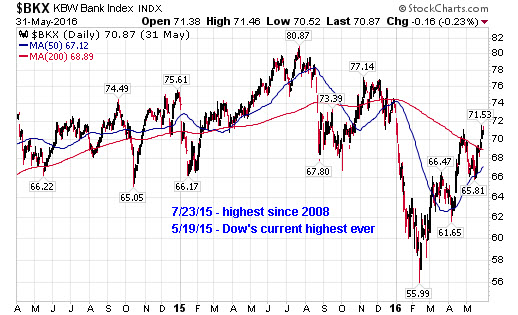

By July 2007 I had already seen the Philly Banking Index decline since February. I had contacted a few of my Wall Street level sources for areas I should be watching. One individual told me to pay close attention to two big hedge funds at Bear Stearns that were close to being shut down. Their total value at the end of 2006 was close to $20 billion. On July 16, 2007, the two funds were closed. One source stated that one fund’s assets were valued at zero and the second at 9 cents on a dollar.

Two Big Funds At Bear Stearns Face Shutdown, WSJ, June 20, 2007

“Two big hedge funds at Bear Stearns Cos. were close to being shut down last night as a rescue plan developed over several days fell apart in a drama that could have wide-ranging consequences for Wall Street and investors.

Merrill Lynch & Co., one of the hedge funds’ lenders, said it would move to seize collateral — much of it mortgage-backed debt — from the two funds and sell it, according to documents reviewed by The Wall Street Journal.”

Since this is all history now, everyone can say, “Oh, I knew that the markets were going to fall.” However, in July 2007, the mood was very different.

On Sunday, July 22nd, I ran into a financial advisor at my church. He had signed up for my free educational services, so had received the group email on the 19th.

“Hey, are you still looking for a collapse?” he said sarcastically.

“We all have our opinions”, I stated, and walked off.

A few weeks later, anyone reading headlines knew we had entered a credit crisis. However, since we are wired to desire more, and the financial industry feeds the idea that every decline is merely a correction before soaring higher, by October, breaking 14,000 again was seen as normal, and looking for prices to be cut in half seen as nothing more than “naysayers”.

However, we all know today, that history was about to change the perception of investors in 2008. By the time these comments were made by President George W. Bush to the American people, we had already seen the collapse of Bear Stearns in March and the bankruptcy of Lehman Brothers and the nationalization of AIG in September. Like today, these events did not come because there were no financial facts supporting we were living in a financial bubble in 2007, but because the feeling from rising prices built on “unlimited” cheap debt was far more “positive” while it lasted.

[President George W. Bush, The Economy & The Bailout: Primetime Address to the Nation, Washington, DC, September 24, 2008]

“Good evening. This is an extraordinary period for America’s economy. Over the past few weeks, many Americans have felt anxiety about their finances and their future. I understand their worry and their frustration. We’ve seen triple-digit swings in the stock market. Major financial institutions have teetered on the edge of collapse, and some have failed. As uncertainty has grown, many banks have restricted lending. Credit markets have frozen. And families and businesses have found it harder to borrow money.

We’re in the midst of a serious financial crisis, and the federal government is responding with decisive action….

In close consultation with Treasury Secretary Hank Paulson, Federal Reserve Chairman Ben Bernanke, and SEC Chairman Chris Cox, I announced a plan on Friday. First, the plan is big enough to solve a serious problem. Under our proposal, the federal government would put up to $700 billion taxpayer dollars on the line to purchase troubled assets that are clogging the financial system. In the short term, this will free up banks to resume the flow of credit to American families and businesses. And this will help our economy grow….”

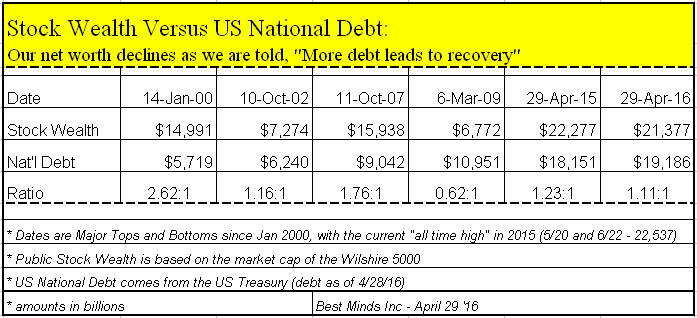

It is no longer September 2008. It is now June 2016. The problems from the ultra cheap loans into the trillions that lead to the credit crisis of 2008 were never addressed. Global debt is now over $200 trillion, an increase of over $60 trillion since Q4 2007 when the Dow left its 14,000.

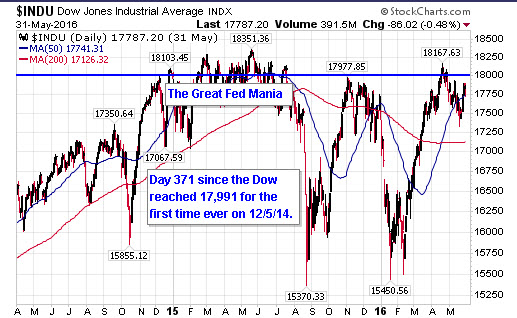

At the end of May 2016, the Dow is still hanging close to its all time high from over a year ago, and yet has seen two plunges from its 18,000 twice, both declines taking the Dow down over 2500 points in less than a month.

Yet even the most powerful financial organizations in the world continue to reveal that 7 years of “unlimited debt and intervention” have not created a strong growing economy.

The IMF Slashes World Growth Forecasts Again, CNBC, April 12, 2016

Global growth continues, but at an increasingly disappointing pace that leaves the world economy more exposed to negative risks. Growth has been too slow for too long,” IMF Chief Economist Maurice Obstefeld told a media conference on Tuesday, according to prepared remarks.

G7: Global Economic Growth An ‘Urgent Priority’, Al Jazeera, May 27, 2016

The leaders of the G7 group have said the world economy is an urgent priority and cautioned that a British vote to leave the European Union would seriously threaten global growth.

Act Now, Or Risk Another Deep Downturn, OECD Warns Policymarkets, Yahoo Finance, June 1, 2016

In the OECD’s (an international economic organization of 34 nations) latest economic outlook published on Wednesday, the organization said that global growth had “languished over the past eight years as OECD economies have struggled to average only 2 percent per year, and emerging markets have slowed, with some falling into deep recession”….

“The need is urgent. The longer the global economic remains in the low-growth trap, the more difficult it will be to break the negative feedback loops, revive market forces, and boost economies to the high-growth path. As it is, a negative shock could top the world back into another deep downturn,” Mann said.

World Bank Cuts Global Growth Forecast on Weak Demand, Commodity Prices, Financial Express, June 7 ’16

The World Bank slashed its 2016 global growth forecast on Wednesday to 2.4 percent from the 2.9 percent estimated in January due to stubbornly low commodity prices, sluggish demand in advanced economies, weak trade and diminishing capital flows….

The downgraded World Bank forecast follows a similar move by the International Monetary Fund, which cut its growth forecasts two months ago.

With all the strong concerns about the global economy slowing from the world financial organizations listed above, shouldn’t both investors and advisors be asking WHY does the Dow keep returning to its first in history 18,000 level, and ignoring headlines like the ones above?

Remember 2007 when the Dow went to 14,000 for the first time in 2007? Remember how the KBW Bank Index was dropping months ahead of the broader US stock indices. As of May 31, 2016, the KBW Bank Index, after two big drops, and two big rallies, is still down 12.4% lower than its 2015 high. Are the big banks telling everyone something?

Unlimited Debt and State Intervention Was Wrong From the Start

We are quickly running out of time to sit silent and ignore this 800-pound gorilla. We must choose between two paths. The first is to continue to ignore this problem, the lessons from the 2000-2002 and 2007-2009 collapse, and the destruction straight ahead to the lives of people all over the world. We must embrace the expansion of the state and the constant “assistance” we have seen since 2009 by central banks around the world through additional trillions in ongoing bailouts in our financial markets, even the direct actions to buy up certain markets in order to artificially inflate them for a few years.

The second is to face these real world problems. We must start quickly by talking about these problems, that will impact every individual, community, school, and place of worship across our nation, and for that matter, world.

Will we speak out? Will we sit silent? One thing is for certain, hoping for more corruption of our markets and economy by central bankers and global politicians is immoral.

The trouble is finding ways to talk about what our globalist, materialist centered world has come to believe is permanent, which never was: the path to riches from bankrupting the nations.

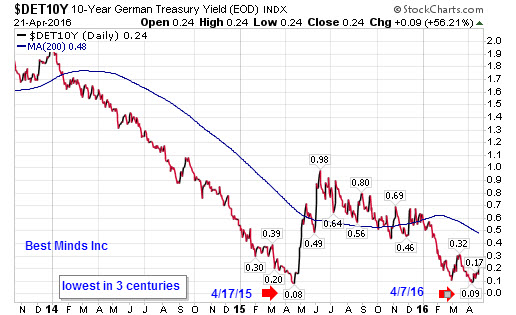

Everyone needs to consider the hard facts presented in one of my recent articles, When Rare Data Screams, Listen. Anyone who remembers the double-digit CD rates from the early 1980s really needs to check this one out. This is history!

* 1981 – Annual high in the Dow was 1,050. US national debt crosses $1 trillion for the first time. 2015 – Annual high in the Dow hits 18,351 on May 19th. The last day of 2015 the national debt hits 18.9 trillion.

A Curious Mind