By 2024, global risks from flagrant financial bubbles in 2017 will have been recognized. For today, one can only seek to influence those willing to think outside the conventional, “‘they’ will take care the big problems” view.

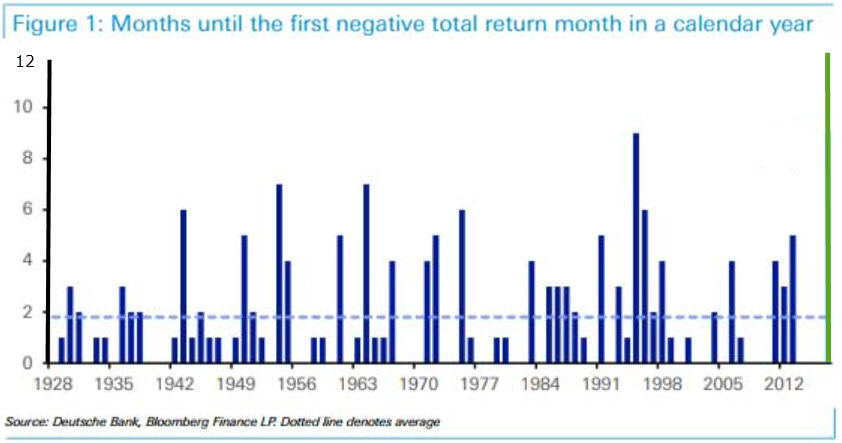

As 2017 comes to an end, the “perfect” stock market has been drilled into the minds of the American investor like none that has existed in the 121-year history of the Dow Jones Industrials. The chart below, developed by Deutsche Bank, is yet one more example of how 2017 has not only been bullish for stocks but has been at a level of “perfection” not seen before.

Is this a good thing? I think not if one considers the long history of cycles and credit in history. Let me illustrate.

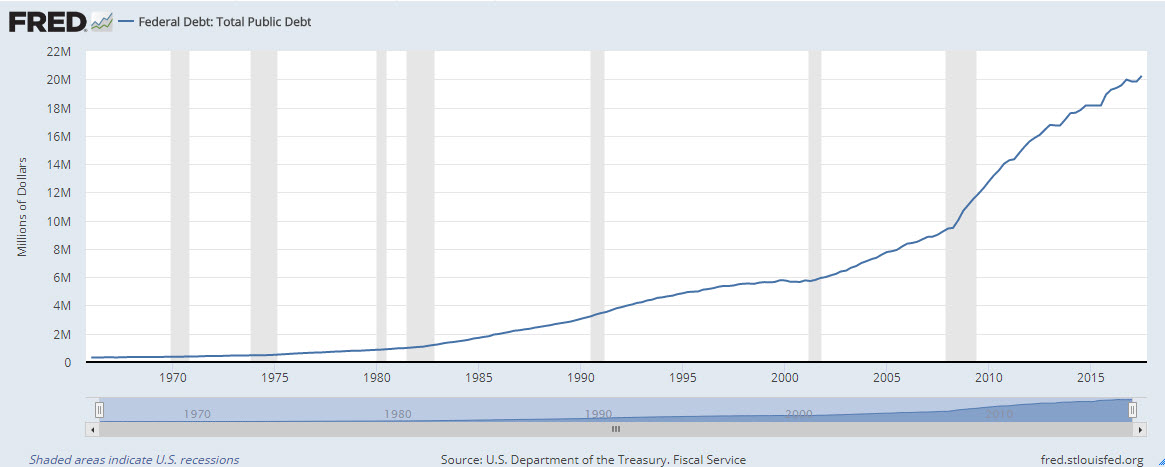

In 1981, I began work on my Master’s degree. Americans would see the national debt top $1 trillion for the first time. If your money market was not paying double digits, you moved your money.

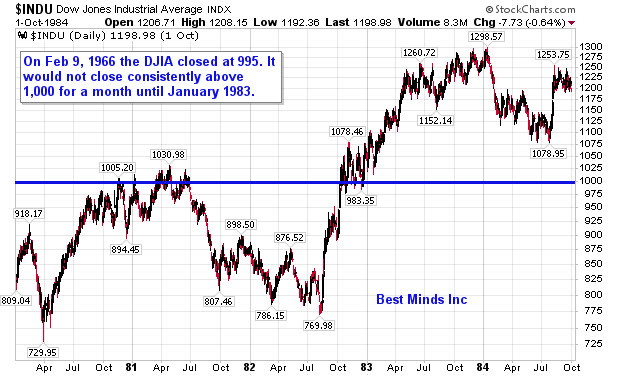

Yields on 10 Year US Treasuries reached 15.84% in October 1981. In January 1983 the Dow closed above 1,000 for an entire month, a first in its history after reaching 995 for the first time in February 1966.

Yes, the money world of the early 1980s differed greatly from 2017.

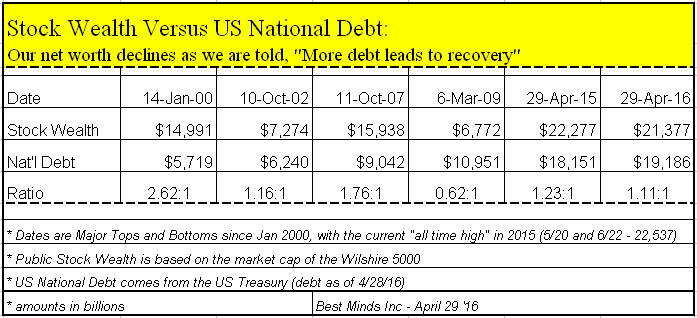

If someone told us that 36 years later we would see the US national debt climb $1 trillion in a year to cross $20 trillion, money markets at the biggest banks paying less than 0.50% for deposits under 100,000 (a trend since 2014), and the Dow leap 7,000 points over 14 months to almost 25,000…. would we have believed them? Not based on the experience from 1966 to 1981.

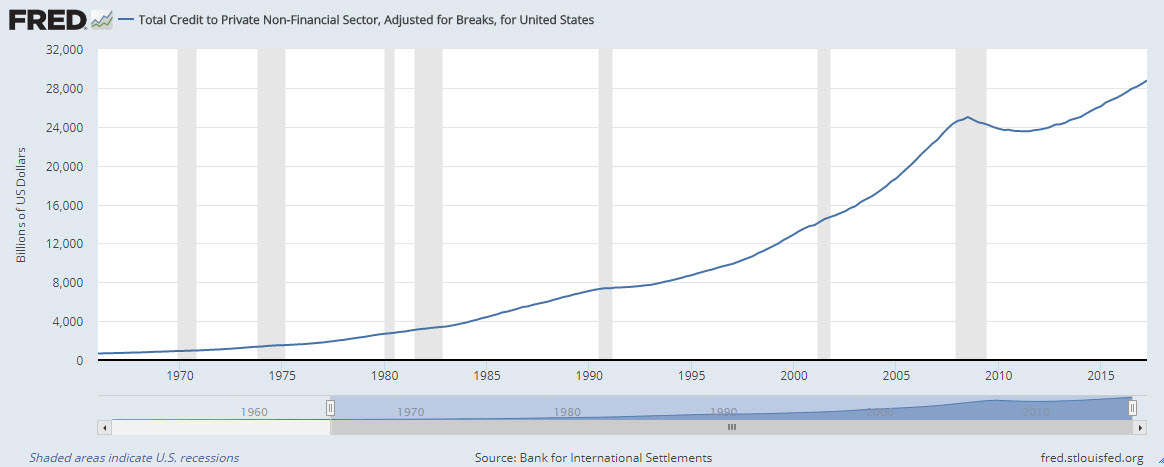

So is it hard for us to believe the period ahead might not produce an additional $19 trillion in debt alongside another 24,000 increase in the Dow, WHILE interest rates plunge even LOWER than their LOWEST in American history as seen in 2016?

[Source – Is This the Most Important Chart in the World, Zero Hedge, Dec 27 ‘17]

Cycles have come and gone in history. Bubbles and come and gone in history.

One thing history has taught investors willing to learn from world events since the Dutch Tulip Bulb in the early 1600s is that the more “perfect” any investment theme has captured the minds of the public, the more disastrous the period following when money flowing from the herd changes directions.

The panic to keep from missing out stopped. The panic to get out began.

In the fall of 1981, the cost to borrow money for US government reached its highest in American history.

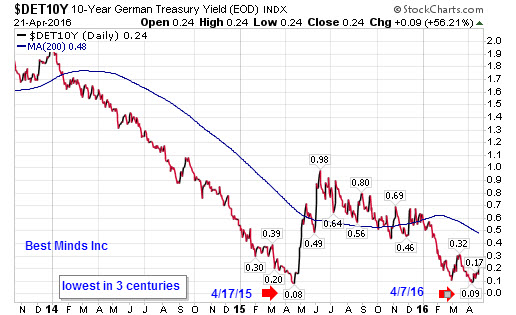

In the summer of 2016, the cost to borrow money for the US government reached its lowest in American history.

Has this 35-year bond market bull (interest rates coming down, bond prices moving higher) ended?

Could investors learn from the 35-year period leading up to 1981 as we start through 2018?

“The great bear market lasted some thirty-five years, by far the longest duration for a bear bond market in U.S. history. If a constant maturity thirty year 2 ½% bond had been available throughout this second bear market of the century, its price would have declined from 101 in 1946 to 17 in 1981, or 83%. In contrast, in the first bear bond market of the century, 1809 to 1920, the same bond would have declined 35% in price. The recent bear bond market seemed to have much more social and economic significance than that of all earlier bear bond markets. In all the others, bond yields stayed within the traditional band that had prevailed for centuries. This time they broke decisively out of that band.” [A History of Interest Rates, Third Edition Revised (1996), Sidney Homer and Richard Sylla, page 367]

“The great bear market lasted some thirty-five years, by far the longest duration for a bear bond market in U.S. history. If a constant maturity thirty year 2 ½% bond had been available throughout this second bear market of the century, its price would have declined from 101 in 1946 to 17 in 1981, or 83%. In contrast, in the first bear bond market of the century, 1809 to 1920, the same bond would have declined 35% in price. The recent bear bond market seemed to have much more social and economic significance than that of all earlier bear bond markets. In all the others, bond yields stayed within the traditional band that had prevailed for centuries. This time they broke decisively out of that band.” [A History of Interest Rates, Third Edition Revised (1996), Sidney Homer and Richard Sylla, page 367]

“An entirely new and revolutionary phase of bond market history began in 1965. The Great Society program was underway, and business was assured that never again would even the smallest recession be permitted. Many believed just this. There seemed to be no more risk…..Then suddenly the (bond) market collapsed, led by a sharp decline in the bellwether, the recently issued 4 1/4s of 1987-1992…Market psychology, which had clung to traditional benchmarks was shattered, and the stage was set for a major bear market.” [Ibid, pg 379]

Still thinking,

A Curious Mind