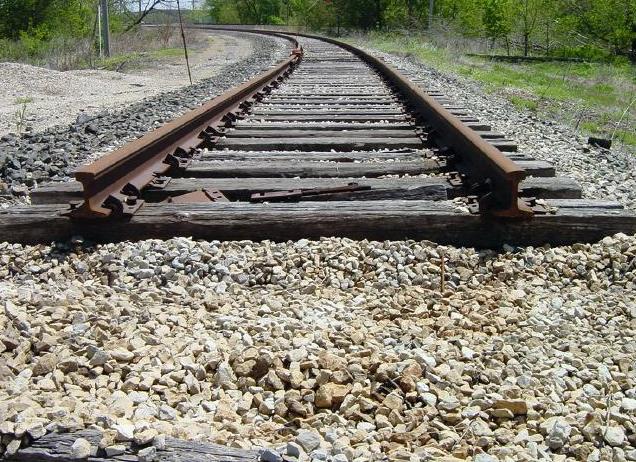

Since 1971, the world has been on the train of unlimited debt. With the US dollar being removed from its gold standard, all checks against a continuing extension of the rail lines have been removed. Unlimited debt is now the “solution” to “random” financial crises caused by too much debt. “Prosperity” has evolved into a permanent rail line, or so we are lead to believe.

What individual getting on a train in California and riding to Virginia would be surprised when told they had come to the end of the line? Would they expect someone to extend the track another hundred or two hundred miles over the Atlantic? Even if that were the case and the ride was smooth for a little longer, there would be an uneasy feeling that consequences were coming.

This is not an American view, this is a world view. Anyone taking a train into Hong Kong, Tokyo, Sydney, or Rio de Janeiro would face the same problem if those lines were extended out over the ocean.

Yet this is exactly what is embedded in the minds of the public; the longer the line can be extended, the more prosperity can come from unlimited debt and state intervention.

We know that a business or individual is not on a long-term sustainable path by taking on more and more debt to create wealth without paying down debt. So why believe that a nation can do this? Simple. Our experience.

An Italian Rail Line

For the individual reading this in 2024, you will see clearly how this story unfolded. But today, in 2016, the majority view is that global rail lines have infinite possibilities. Yet the minority voice is getting louder as the waves of problems get higher.

January news stories showed a rising level of non-performing loans in Italian Banks, loans where payments were either behind or had stopped.

This reached a level by the end of last year not seen since 1996.

Italian Bank’s Bad Loans Continue To Mount, MarketWatch, Jan 20 ’16

According to data published Tuesday by Italy’s banking lobby ABI, Italian banks’ gross bad loans, measured at their face value, stood at EUR201 billion in November, 11% higher than the same period a year prior.

Gross bad loans were 10.4% of total loans in November, the highest percentage figure since 1996.

Had the European Central Bank (big global central bank) provided bailouts for European banks before 2016? Of course, and at levels never seen in history.

Eurozone Bank Lending Slows Despite ECB’s 1 Trillion Cheap Loans, The Telegraph, April 20, 2012

ECB Poised To Launch 1 Trillion Quantitative Easing, The Guardian, January 22, 2015

So what was the solution for extending the rail lines recently?

Next Stop on the ECB Adventure: $980 Billion in Corporate Bonds, Bloomberg, March 10, 2016

Life goes on as abnormal, right? Yes, for the time being, but now without a great deal of misinformation to the public and yields plummeting so low on European government bonds that rebellion eventually comes.

Let me illustrate.

Mish Shedlock reveals one glaring problem from laying down this recent track to prosperity by the ECB. A reader of Shedlock’s writings, “Lars”, makes this observation:

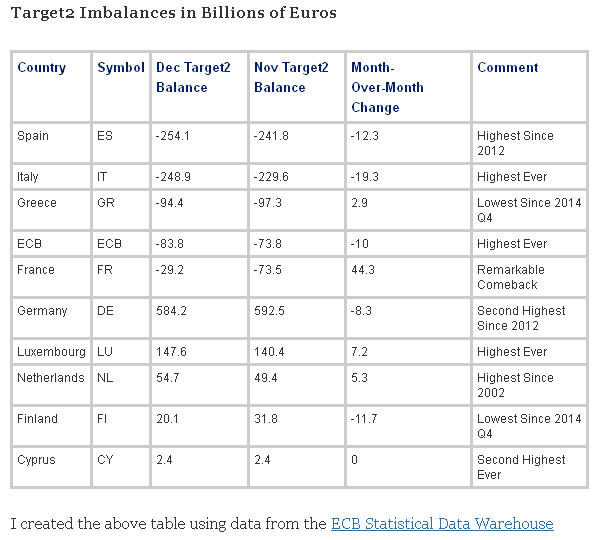

The Italian central bank has under Target2 borrowed €250 billion, mainly from Bundesbank. The loan is unsecured, not a single € in collateral. The 250 billion is then lent to Italian banks, all of them insolvent. [Is the ECB Bailing Out Banks on the Sly?, Mish Shedlock, May 1 ‘16]

Will lowering borrowing costs, pushing interest rates to negative, and artificially stimulating short term rallies fix these large financial problems?

Richard Koo, Chief Economist at Nomura Securities in 2003, made it clear what needed to be done to reboot Japan’s financial institutions after years and years of constant bailouts.

The NPLs (non performing loans) should be disposed of in an orderly and predictable manner. The pace of disposal should be determined collectively by the banking authorities and the private-sector banks to ensure that the resulting deflationary impact on the economy is minimized. [Balance Sheet Recession: Japan’s Struggle With Uncharted Economics and Its Global Implications (2003), Dr. Richard Koo, pg 273]

The NPLs (non performing loans) should be disposed of in an orderly and predictable manner. The pace of disposal should be determined collectively by the banking authorities and the private-sector banks to ensure that the resulting deflationary impact on the economy is minimized. [Balance Sheet Recession: Japan’s Struggle With Uncharted Economics and Its Global Implications (2003), Dr. Richard Koo, pg 273]

Anyone following the headlines knows that Japan chose to bury these loans with more debt, rather than deal with this structural problem.

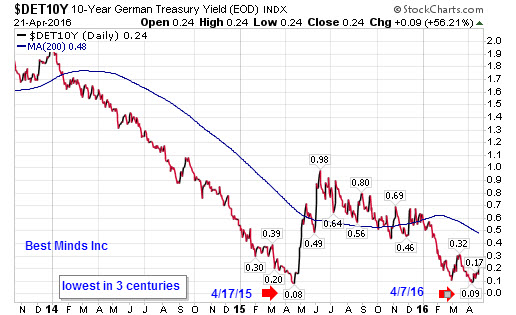

If we look at charts of Italian and German bond yields, we see that once these “rescue” programs STARTED, government bond yields went higher, now lower. Oops.

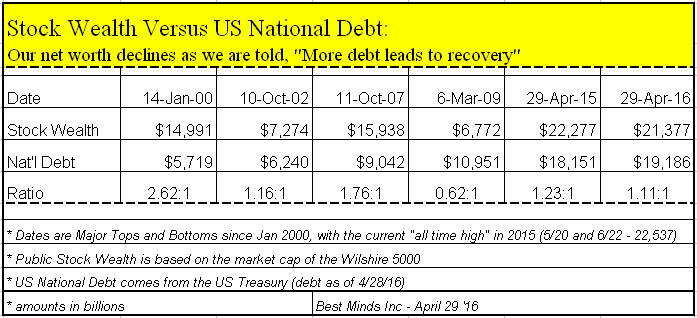

How can the problem of too much debt be corrected by creating trillions out of thin air to push borrowing costs to historic lows? Yes it extends the tracks, but for how long and at what long term cost? When the time comes to sell the assets the central banks are buying, who will have a few trillion lying around to buy them? Who wants bond yields at three CENTURY lows?

Shedlock presented the chart below three months ago. By using the ECB’s own data, it is clear that the 2 trillion in bailout programs announced and launched since December 2011 did not stop Spain and Italy’s banks from experiencing massive capital outflows by December 2015.

Italy’s banks experienced the highest monthly outflow of capital on record.

[Chart from Capital Flight Intensifies in Italy and Spain; Curiously, Money Flows Into French Banks, Mish Shedlock, Feb 9 ‘16]

What is very clear from Europe and Japan, is that time is running out on the use of more debt to extend the tracks without severe consequences. The public is starting to wake up to real world realities that no amount of central planning can stall. The actions of some passengers show they want to get off the train.

Italian Banks Under Pressure As Popolare di Vicenza IPO Fails, The Guardian, May 2 ‘16

Italian banking shares have come under pressure after the planned listing of regional lender Popolare di Vicenza flopped and the latest government measures aimed at tackling the sector’s bad loans fell short of expectations.

The stock market in Milan said it could not allow Popolare di Vicenza to list after investors bought just 7.7% of its €1.5 bn share issue….

Italian bank shares have lost nearly a third of their value this year due to concerns about €360 bn of bad debts accumulated during a three-year recession, while negative interest rates are also eroding bank profits.

Japan’s Negative Interest Rates Are Driving up Sales of Safes, Fortune, Feb 23 ‘16

That’s not great news for the Bank of Japan.

The Japanese are spending—but not in a way that is likely to strengthen the country’s economy.

Following the Bank of Japan’s decision to lower interest rates below zero in January, many consumers have reportedly rushed to hardware stores in search of one thing: safes.

As we continued to watch what is taking place around the world, could the day come when the Dow at 18,000 is a thing of the past, a reflection of a society that had placed its faith in an unstoppable train built on unlimited debt and central banking intervention?

“Ordinary people have the ability not to think about things they do not want to think about” Blaise Pascal

A Curious Mind