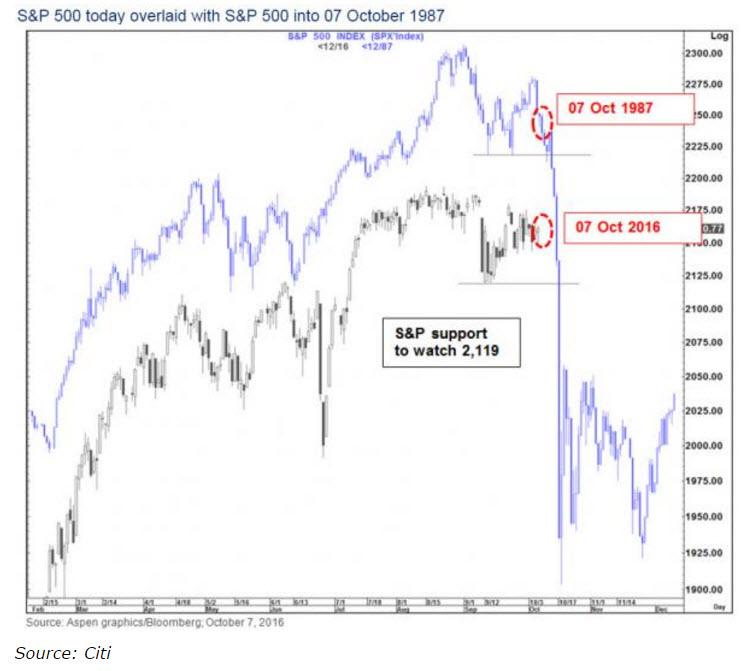

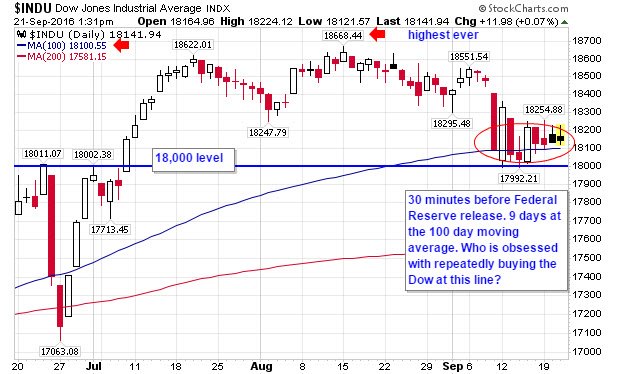

It is now November 2016. By 2024, we will wonder how we could ignore so many warnings. The way we receive our news as Americans, I doubt most individuals know anything about what has taken place since November 8th in India. Our focus, and it certainly is very important, has been on our national elections, especially the President. However, what has been going on in India is important to everyone seeking to understand historical trends in the world of money and their impact to our lives if these trends are not altered.

This is a major event in the continuing move toward a global cashless society.

I was alerted to this story by a colleague of mine who grew up in India.

For us in 2016 we certainly see the world around us becoming more cashless, but removing large amounts of cash from use? Maybe in the movies, but real life? For the world in 2024…well, looking back everyone could have a very different view by then.

Good Morning, Hand Us Your “Big” Bills

I started my day like any other, reviewing my emails and various news sites. When I opened the email from a member of one of my Austrian economics chat groups, I was immediately curious about two of his recent writings on what the people of India were experiencing with their own money since last week since he was Indian.

I have linked both of his articles in this post – contain videos as well – and would encourage anyone to read them and watch some of the videos. This is a huge deal, yet as is common in my country, America, the majority know nothing about these developments or how this could impact our lives in the future.

This is a condensed version of events. We start with the day one after the Prime Minister’s announcement.

Last night (8th November 2016), India’s government banned the use of Rs (rupees) 500 (app. $7.50) and Rs 1,000 ($15) banknotes. This pretty much made most currency – in – use illegal. Banks and ATMs are closed today. The government believes that doing this will help eradicate corruption and push counterfeit money out of circulation. According to the Indian government, the counterfeit money tends to come from Pakistan and helps finance terrorism.

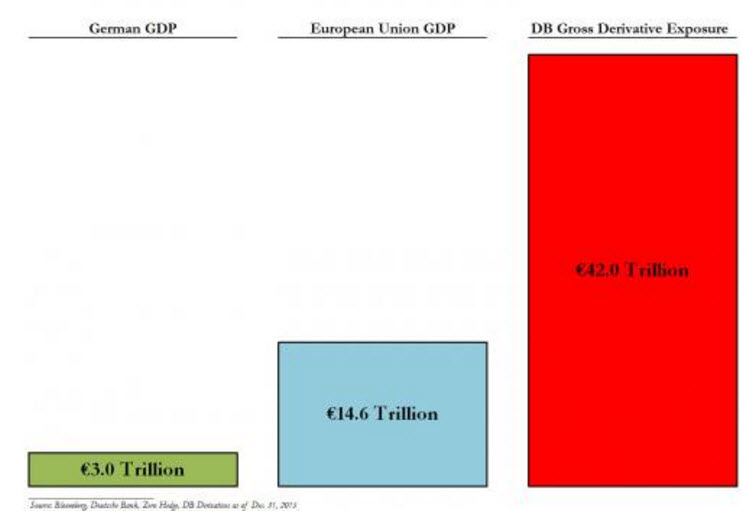

India being the second most populated nation behind China should tell the world that we should not take this is merely some random event that has no relevance to our own lives. India is also a member of BRICS, a group of nations that have been gaining financial clout as a group on the world stage for more than a decade. Collectively their populations make up over half the global population and 22% of global gross domestic product. In 2014, the group launched The New Development Bank.

‘BRICS’ nations to form development bank to rival World Bank, IMF, LA Times, 7/15/14

We return now to recent events, where we see that corruption is increasing, not decreasing from the government’s actions.

Those who find themselves stuck with high denomination bills today, must accept as little as Rs 700 in usable currency for every Rs 1,000 of banned currency.

At least theoretically, people can still use the otherwise banned bills at hospitals, gas stations, pharmaceutical shops, and train stations. As one would expect in India, these places have been converted into corrupt currency-exchange shops as of today.

But for most legitimate uses, none of these organizations are accepting the otherwise banned instruments. Why should they, when they can force customers to pay in the still-legal currency and then buy the banned instruments for Rs 700 for every Rs 1000 in face value, making a neat 43% extra profit without doing anything?

So much for slowing down corruption. But it gets worse.

Today, there is utter chaos in the market, with only the spontaneously erupted black market available to bypass the ban – most people simply don’t have anything else but the banned currency bills. Some are booking train tickets for future rides and are subsequently canceling them – they can use the banned currency to buy the tickets and can then get legal currency back after ticket-cancellation charges. This is costing people a lot of time, but it is the only way they can stay afloat and buy food. Others are taking different measures, equally desperate.

By any sane person’s reckoning, corruption has skyrocketed for the moment. So has gold (in some places physical gold had reached US $2,294 per ounce). Those who run businesses have lost whatever remnant of trust in the government they still had. In recent months several businessmen have confessed to me that they are closing down because the state has become increasingly heavy-handed and bureaucratic. Contrary to what the World Bank and IMF are saying, India is suffering economically. Its institutions are crumbling.

The comments above by an Indian, were written the morning after their Prime Minister banned the 500 and 1000 bills from circulation, these two bills representing 86% of the nation’s cash in circulation.

The following news report from Bloomberg makes it clear that forcing the people to change their old bills for smaller bills when the larger ones were this widely used in daily business is having drastic effects on the people.

The shortage of cash has started to hit movement of goods as well. More than half of an estimated 9.3 million trucks under the All India Motor Transport Congress have been affected as drivers abandon vehicles mid-way into their trip after running out of cash, according to Naveen Gupta, secretary general of the group. India’s roads carry about 65 percent of the country’s freight.

My colleague from India’s second article, dated November 16th, supports the comments above from the Bloomberg article.

Today India is on the verge of a major social-political crisis, unless either the government backs off from the decision of banning the currency or some real magic happens. There is chaos in the streets and daily life is slowly but surely coming to a full halt. …

That same afternoon (first day banks opened), I went to the post office with a friend who wanted to get his money converted. After waiting a long time there, we found out that the post office had run out of cash. Since then most ATMs have had limited amounts of cash available and banks keep running out of cash as well.

Remember Greece last summer? The picture below was posted in the July 2015 post, Optimism Didn’t Help Greeks or Chinese.

From Greece in July 2015 to India in November 2016.

New Delhi: People queue up at out side of banks ATM to get money in New Delhi on Sunday. PTI photo by Vijay Verma(PTI11_13_2016_000071A)

As human beings, may we never forget that terms like GDP, inflation, QE, and interest rates, remove us from the human drama of those hardest hit in the midst of such a financial hurricane. May we remember that this is a story about daily human life and seek to make a difference, even if we touch only a few lives in these growing financial storms around our world.

97% of the Indian economy is cash-based. With 88% of all outstanding currency no longer usable, the economy is coming to a standstill. The daily-wage laborer, who leads a hand – to – mouth existence in a country with the GDP per capita of a mere $1,600, no longer has work, as his employer has no cash to pay his wages.

Half of India’s citizens do not have a bank account and around 25% do not even have an ID card. These are the country’s poorest people, who have no way of converting their money – even if they learn how to do it, which is already a nigh insurmountable hurdle. Also, those who are old, disabled or sick have no choice but to suffer, for without personally visiting a bank branch office, one cannot convert one’s banknotes.

Like cages full of birds their houses are full of deceit; they have become rich and powerful and have grown fat and sleek. Their evil deeds have no limit; they do not plead the case of the fatherless to win it, they do not defend the rights of the poor. – Jeremiah 5:27-28

The righteous is concerned for the rights of the poor, the wicked does not understand such concern. – Proverbs 29:7

A Curious and Caring Mind